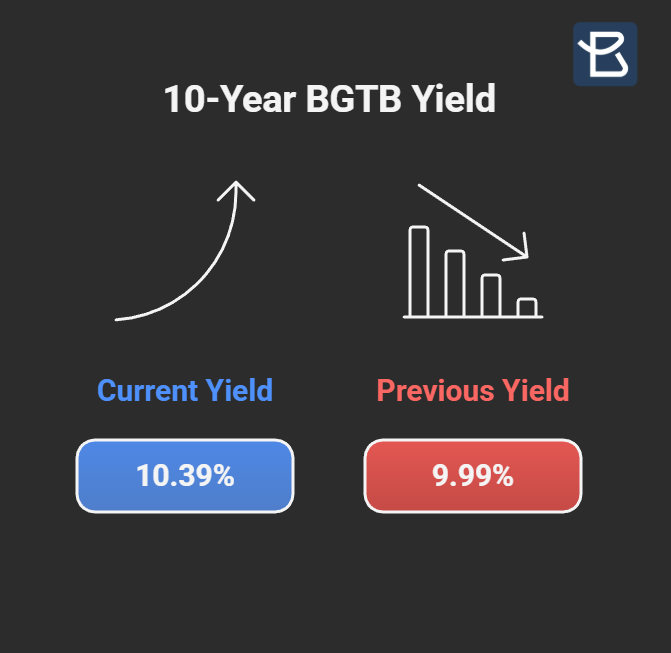

The yield on 10-year Bangladesh Government Treasury Bonds (BGTBs) rose sharply on Tuesday, as banks continued to steer clear of long-term government securities in an effort to manage their portfolios more cautiously.

According to auction results, the cut-off yield climbed to 10.39%, up from 9.99% previously. Despite the higher rate, the government managed to raise Tk 25 billion through the issuance to help finance its budget deficit.

A senior treasury official at a leading private commercial bank said most banks are hesitant to park excess liquidity in long-term bonds.

“Banks are avoiding long-term securities to manage their portfolios efficiently,” he said.

A central banker noted that the current upward trend in yields is likely to persist in the coming weeks.

The market currently trades five types of government bonds with maturities of 2, 5, 10, 15, and 20 years.

Additionally, four treasury bills—maturing in 14, 91, 182, and 364 days—are auctioned to facilitate short-term government borrowing from the banking system.