Thirty-one banks collectively lost Tk 3,600 crore from their stock market investments in 2024, with state-owned lenders taking the biggest hit amid a sluggish market and poor investment choices.

The losses were mostly “unrealised” — meaning banks did not sell their holdings, but the value of their portfolios fell sharply. Private banks also reported sizeable markdowns, while foreign banks, which stayed away from the local bourse, escaped the rout.

Analysts say much of the damage came from reckless bets on junk stocks and troubled firms. Many banks lost heavily on the Beximco Green Sukuk Bond, whose price halved to Tk 40 last year after Beximco Group owner Salman F Rahman was jailed following the political changeover in August 2024. Others sank money into long-troubled firms like ICB Islamic Bank and People’s Leasing.

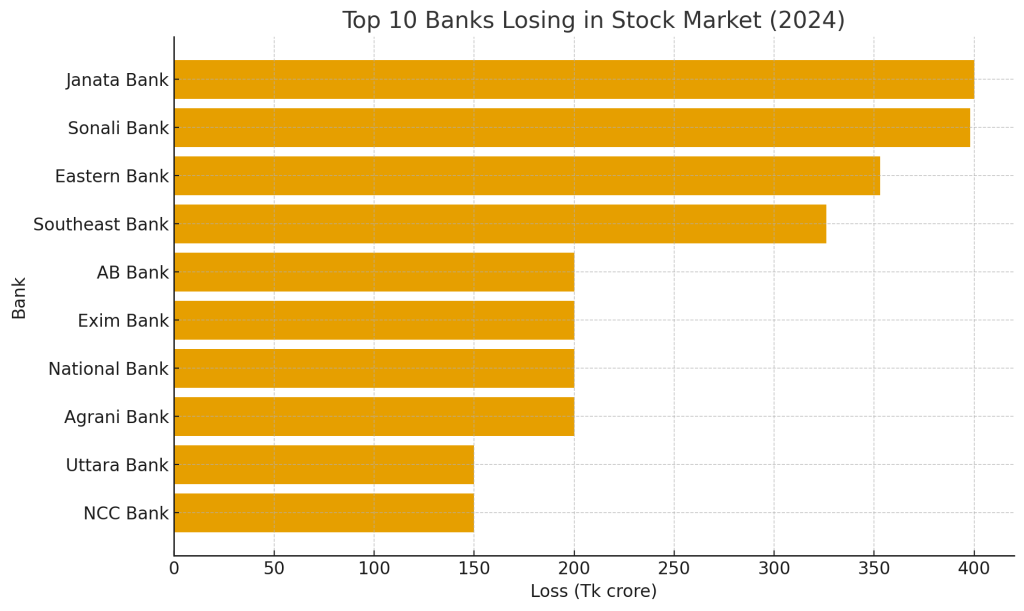

Janata Bank alone lost Tk 400 crore, mostly from the Sukuk Bond, Summit Power, Best Holdings, and fixed income funds. It also holds Tk 50 crore in junk shares including AB Bank, National Bank, and Phoenix Finance. Sonali Bank followed with Tk 398 crore in losses, Eastern Bank with Tk 353 crore, and Southeast Bank with Tk 326 crore. AB Bank, Exim Bank, National Bank, and Agrani Bank each lost over Tk 200 crore, while several others, including Rupali, Uttara, and NCC Bank, lost between Tk 100–200 crore.

Only three banks — Mercantile, BRAC, and Prime — managed gains from their stock investments.

Experts said the debacle exposed deep flaws in how banks manage their portfolios. “Banks are not supposed to invest in the share market as returns are uncertain while they deal with fixed deposit liabilities,” said Toufic Ahmad Choudhury, director general of the Bangladesh Academy for Securities Markets.

Ali Imam, CEO of Edge Asset Management, added: “Banks follow good governance in core operations but lack expertise in equities. Their officials are trained for collateral-based lending, not managing stock portfolios. Sometimes they invest in shares they would never finance as loans.”

The DSEX index of the Dhaka Stock Exchange fell 16 per cent, or 1,026 points, last year, but analysts argue the weak market was not the main driver of losses. “Portfolio managers do better even in a dull market. Without professionals, banks will keep losing or miss out on returns,” Imam warned.