Deposit growth in Bangladesh’s banking sector remains sluggish, yet several strong banks are slashing rates as surplus liquidity piles up, industry insiders said.

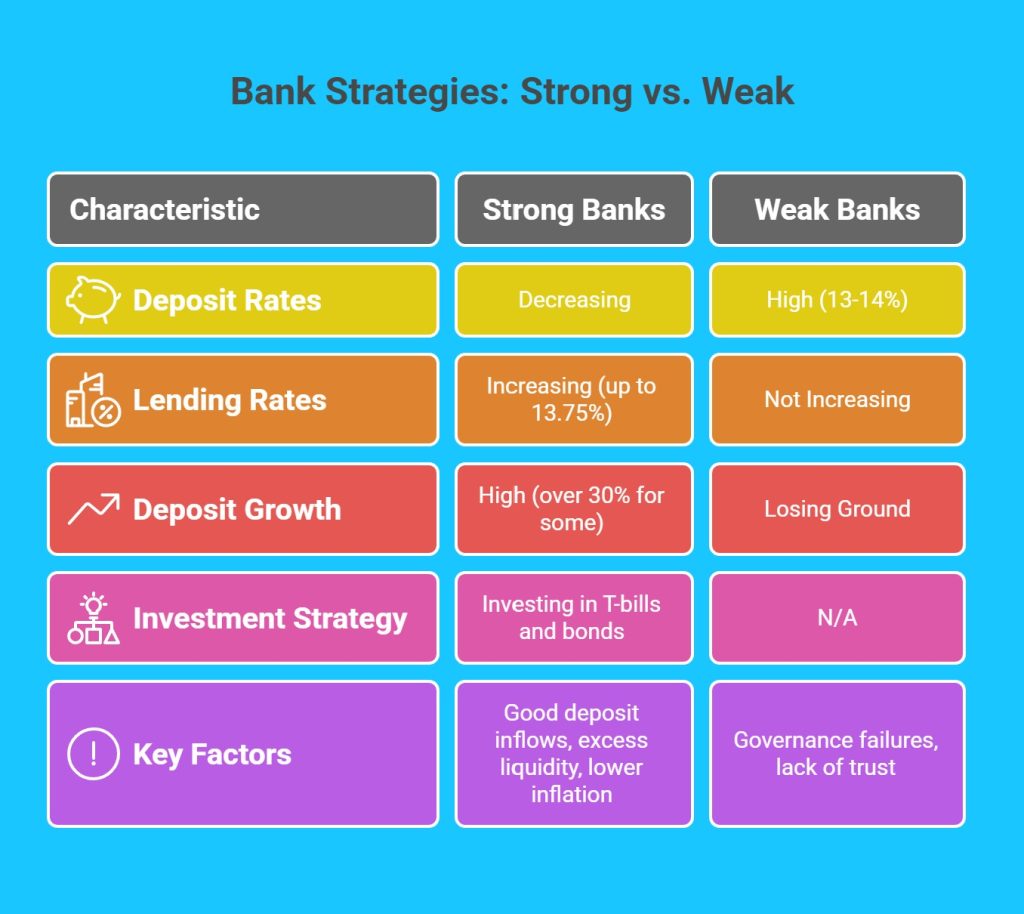

While overall growth has stayed below 8% in nine of the last 12 months — far weaker than the pre-crisis average of 11–12% — deposits have concentrated in 8–10 leading banks. Some of these institutions posted growth above 30% over January–May 2025, largely driven by depositors shifting funds away from weaker lenders after last year’s regime change.

One top-tier bank has already reduced its one-year FDR rate from 11% to 10.25% in just two months, with more cuts expected.

“Banks receiving strong inflows are facing excess liquidity. With treasury yields falling and limited investment avenues, cutting deposit rates is inevitable,” said Mohammad Ali, MD & CEO of Pubali Bank.

Treasury yields have tumbled since June, when the 364-day T-bill peaked at 12.24% and the 15-year bond at 12.59%. By late August, the 364-day yield had fallen to 10.37%, a drop of 187 basis points.

Echoing the trend, City Bank CEO Mashrur Arefin said: “If T-bill yields are around 10%, we cannot collect deposits at 11%.”

Lending Rates Edge Up

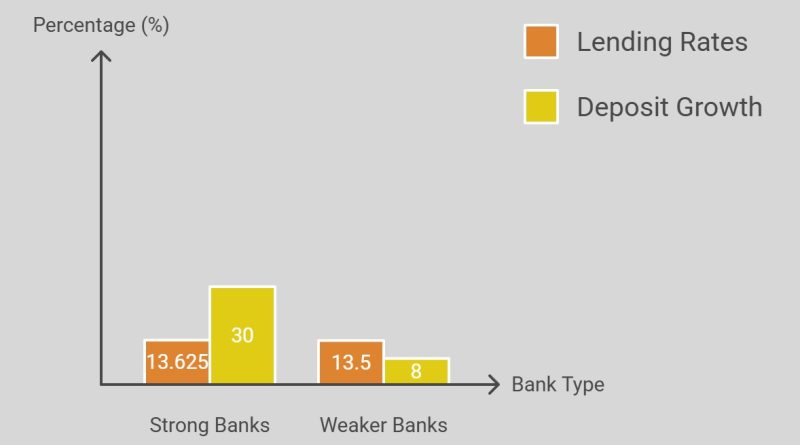

With deposits concentrated among a handful of strong banks, several have raised lending rates — especially for consumer loans. Current rates at these banks stand between 13.5% and 13.75%, up by 50–75 basis points in some cases.

A deputy managing director of a top private bank noted that while corporate lending has seen little change, rates for personal, auto, and home loans have increased due to steady demand and pressure from rising non-performing loans.

Not all lenders are following the trend. Pubali Bank’s CEO said raising lending rates amid weak credit demand would make loans unaffordable and risk further slowing economic growth.

Weak Banks Lose Ground

Smaller and weaker banks, despite offering deposit rates as high as 13–14%, continue to lose market share due to governance failures, liquidity stress, and depositor mistrust.

Bankers say in Bangladesh, reputation outweighs high rates. Strong banks can lower deposit rates yet still attract inflows, while weaker lenders struggle to retain customers.