The government borrowed Tk 65 billion on Sunday by issuing treasury bills (T-bills), as yields on the short-term securities fell further with banks parking their excess liquidity in risk-free assets.

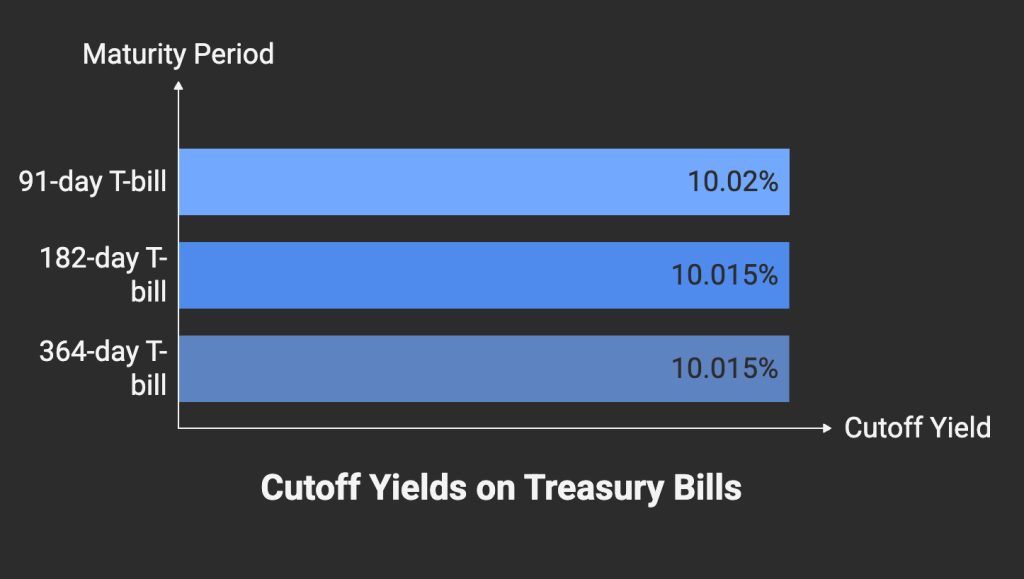

Auction results show the cutoff yield on the 91-day T-bill dropped to 10.02% from 10.07% earlier, while the 182-day and 364-day bills both slipped to around 10.01–10.02%, down from more than 10.13% previously.

“Banks are leaning toward government securities mainly because private sector credit demand remains weak ahead of the national election,” said a senior central bank official, adding that the downward trend in yields is likely to continue.

The government regularly issues four types of T-bills — 14-day, 91-day, 182-day, and 364-day — alongside bonds with longer maturities of up to 20 years, to help manage its budget deficit and borrowing needs.