Interest rates on all Treasury bills in Bangladesh have dropped into single digits for the first time in nearly a year, reflecting excess liquidity in banks and reduced government borrowing.

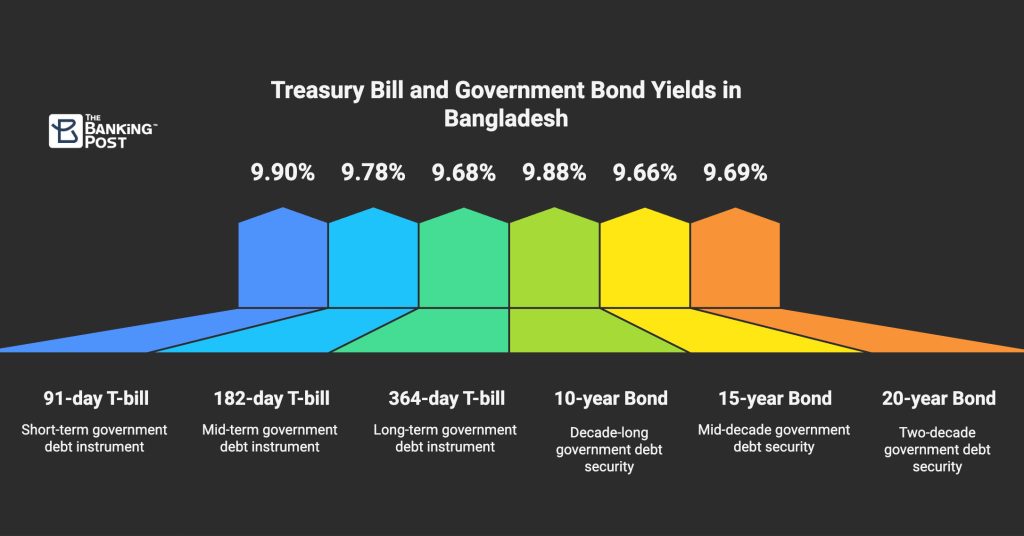

At Tuesday’s auction, yields on the 91-day, 182-day, and 364-day bills stood at 9.90%, 9.78% and 9.68% respectively — down from around 12% in July. Long-term government bonds followed the same path, with 10-year, 15-year and 20-year securities now yielding 9.88%, 9.66% and 9.69%.

Why the drop

Bankers and economists point to two major drivers:

- Bangladesh Bank injected about Tk23,000 crore into the market since July by purchasing $1.88 billion from commercial banks, boosting liquidity.

- The government scaled back its borrowing through Treasury bills and bonds, easing demand pressure.

“Falling below 10% is mainly the result of the central bank’s intervention,” said one bank CEO. Another economist noted that dollar purchases had “expanded money supply and dragged down yields.”

Weak credit growth

With private sector credit growth stuck at just 6.5% in July, banks have parked excess funds into safe government securities. Remittance inflows have also helped sustain liquidity.

What it means for savers and borrowers

Deposit rates at top commercial banks currently range from 8–9%, with some offering below 7%. As government borrowing costs decline, banks are expected to trim deposit rates further.

Lending rates, averaging above 13%, may also face downward pressure. But bankers say any significant cut depends on the central bank’s policy rate, which remains at 10%.

“If the policy rate stays unchanged, deposit rates may fall but lending rates could remain high, widening the bank spread,” one analyst warned.

Economists add that even if lending costs ease, weak investor sentiment may limit fresh investments.