Yields on Bangladesh’s Treasury bills (T-bills) showed a mixed pattern on Sunday, as banks shifted their investment preference toward short-term government securities ahead of the upcoming national election. The move underscores growing caution in the financial sector as institutions seek to balance liquidity management with political and economic uncertainty.

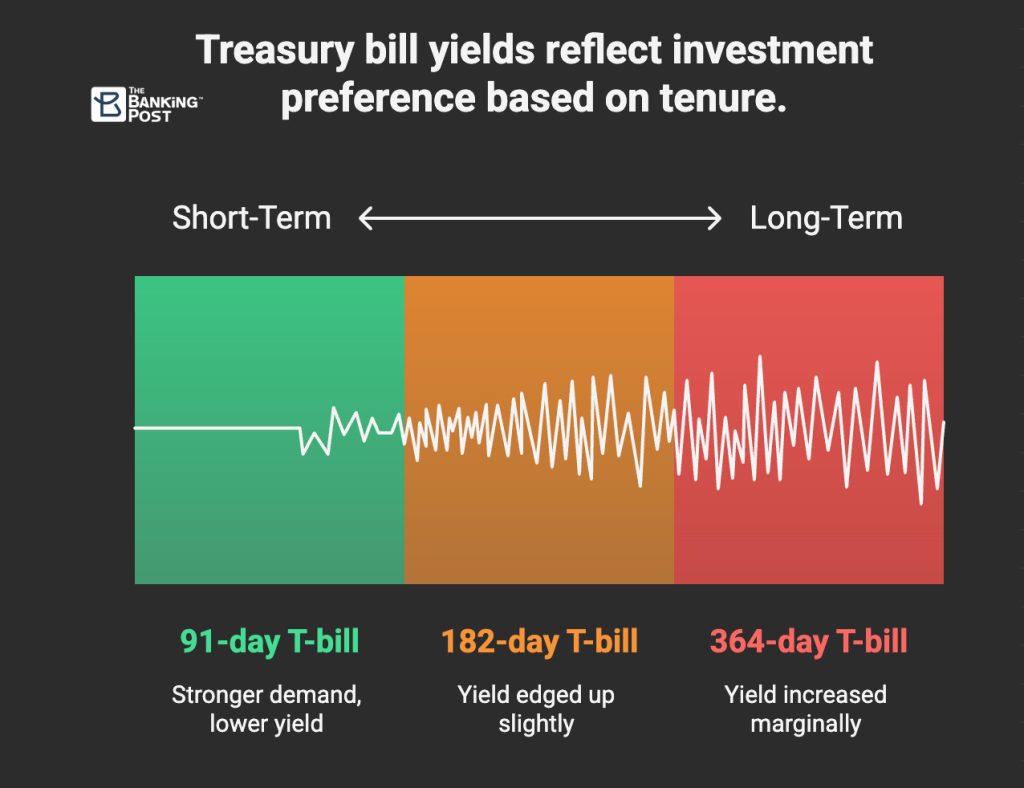

According to the Bangladesh Bank auction data, the cut-off yield on the 91-day T-bill dropped to 9.69 percent from 9.91 percent earlier, indicating stronger demand for short-term securities. In contrast, yields on longer tenures edged up — the 182-day T-bill rose to 9.89 percent from 9.79 percent, and the 364-day T-bill increased slightly to 9.70 percent from 9.68 percent.

On the day, the government mobilised Tk 65 billion through the sale of three types of T-bills, part of its ongoing strategy to finance the budget deficit while managing market liquidity.

A senior Bangladesh Bank official said that most banks were opting for shorter-tenure investments to reduce risk exposure. “The preference for short-term instruments reflects cautious portfolio positioning ahead of the election, allowing banks to remain flexible amid political and economic uncertainty,” the official said.

Market analysts echoed this sentiment, noting that the trend highlights banks’ defensive stance as they await greater clarity on the post-election policy environment. “With inflationary pressures, global interest rate movements, and domestic liquidity constraints in play, banks are prioritising instruments that can quickly be rolled over,” said one capital market observer.

Earlier, on September 28, T-bill yields had fallen below the central bank’s policy rate as banks sought safer investment avenues amid subdued private sector credit demand. The 91-day T-bill yield fell to 9.91 percent from 10.00 percent, while the 182-day and 364-day tenures declined to 9.79 percent and 9.68 percent, respectively.

Currently, the Bangladesh Bank’s policy rate—commonly known as the repo rate—stands at 10 percent. With T-bill yields hovering just below that level, analysts believe banks are taking advantage of the marginally lower yields to park excess liquidity temporarily.

Private sector credit growth, a key indicator of business activity, remained weak. It stood at 6.52 percent in July 2025, slightly higher than June’s 6.49 percent, but still far below the double-digit growth seen in pre-pandemic years. Economists attribute this sluggish growth to cautious lending, reduced investment appetite, and uncertainties surrounding the upcoming election.

Currently, Bangladesh issues four types of T-bills — with maturities of 14, 91, 182, and 364 days — to meet short-term financing needs. In addition, five categories of government bonds, with tenures ranging from two to 20 years, are traded in the secondary market, providing longer-term funding options.

Financial experts suggest that the mixed yield trend could persist in the coming weeks, especially if liquidity levels remain comfortable and private sector demand for credit continues to stay low. They also predict that banks may continue favouring shorter-tenure securities until after the election, when policy directions and fiscal stability become clearer.

“The cautious investment pattern we’re seeing now is likely to continue,” a treasury analyst at a private commercial bank said. “Until the election results bring more certainty, banks will prefer to keep their portfolios short and liquid.”

As Bangladesh’s financial system navigates this pre-election period, the central bank’s policy decisions and the government’s borrowing strategy will remain under close watch. Market participants expect both factors to play a critical role in determining the direction of interest rates and overall investor sentiment in the coming months.