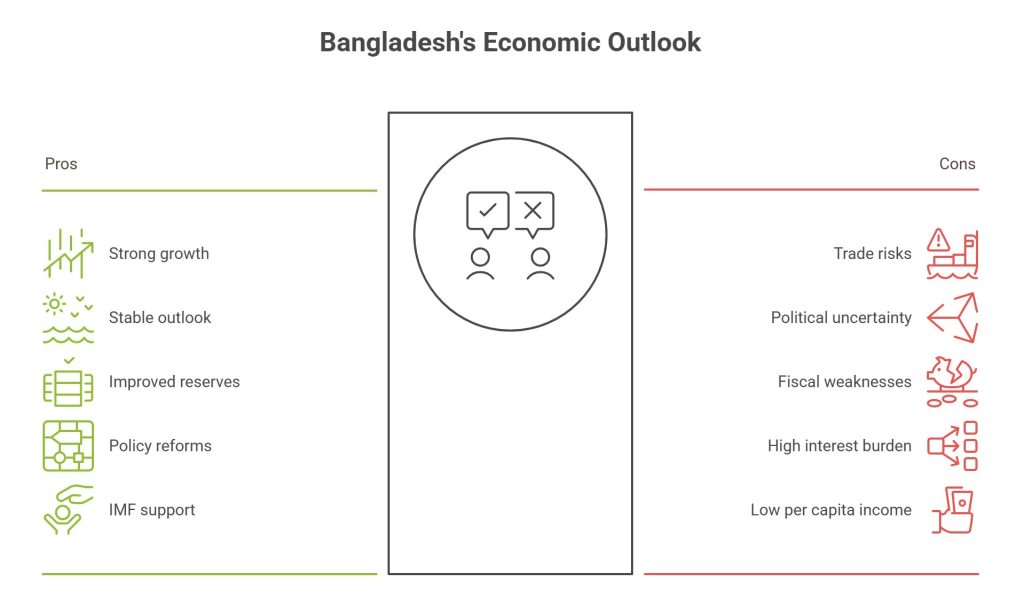

Dhaka, July 26 — Global rating agency S&P Global Ratings has reaffirmed Bangladesh’s long-term sovereign credit rating at ‘B+’ and short-term rating at ‘B’, citing improvements in the country’s foreign exchange reserves and ongoing macroeconomic reforms. The outlook remains stable, reflecting expectations of strong per capita growth compared to peer economies.

The agency said recent policy shifts—including a transition to a more flexible exchange rate regime, depreciation of the Taka, and tighter monetary policy—have contributed to rebuilding foreign currency liquidity and stabilising external accounts.

“We affirmed our long-term sovereign credit ratings on Bangladesh at B+ and short-term ratings at B. The outlook is stable,” said S&P in a statement released Friday.

Reserves Strengthen; Policy Reforms Continue

According to S&P, Bangladesh’s foreign exchange reserves rose by nearly $5 billion in FY25, reaching $26.7 billion, up from below $20 billion in the previous fiscal year. This covers approximately 4.1 months of current account payments, compared to 3.3 months a year earlier.

The Bangladesh Bank’s efforts to maintain a high policy interest rate of 10 percent, despite persistent inflation, have also supported external stability, S&P noted.

The country is continuing to implement key reforms under its $4.7 billion IMF programme, including the Extended Credit Facility (ECF), Extended Fund Facility (EFF), and Resilience and Sustainability Facility (RSF). Reforms focus on reducing reliance on high-cost domestic debt instruments, improving macroeconomic data reporting, and adjusting petroleum prices to reduce subsidy expenditure.

In June, the IMF’s executive board completed its combined third and fourth reviews under both the EFF and RSF programmes, unlocking $884 million and $453 million, respectively.

Trade and Political Uncertainty Pose Risks

Despite the improving macroeconomic indicators, S&P cautioned that Bangladesh faces notable external and political risks. A proposed 35 percent tariff on Bangladeshi exports to the U.S., set to take effect on August 1, 2025, may negatively affect the country’s export-driven economy and labour market if no bilateral resolution is reached.

The report also noted that political uncertainty following the collapse of the Sheikh Hasina government in August 2024 could constrain policy effectiveness in the near term. S&P views the upcoming general elections in the first half of 2026 as a crucial juncture for restoring institutional and political stability.

Strong Growth Potential, but Fiscal Weaknesses Remain

S&P projects that Bangladesh’s annual GDP growth could rebound to around 6.1 percent over the next three years, assuming improved political and external stability. The agency also estimates the country’s 10-year average real per capita GDP growth at approximately 4.3 percent, significantly higher than the median of similarly rated countries.

However, structural challenges remain. Bangladesh’s per capita income, projected at $2,620 in FY25, remains modest and a key rating constraint. The fiscal deficit is expected to hold steady at around 4.6 percent of GDP, while the net general government debt is forecast to average 35 percent of GDP through FY2028.

S&P flagged Bangladesh’s elevated interest burden, estimated at 26 percent of government revenue, as a concern stemming from low tax collection. The country’s narrow revenue base continues to limit fiscal flexibility and constrain the government’s ability to provide economic stimulus during periods of stress.

“Revenue generation remains critically low, both as a share of GDP and compared to similarly rated sovereigns. Without greater political stability, structural fiscal reforms may remain out of reach,” S&P noted.

Outlook

While the outlook remains stable for now, the agency said that any deterioration in the external environment, prolonged political instability, or failure to implement key fiscal reforms could trigger negative rating actions in the future. Conversely, significant progress in structural reforms and revenue mobilisation could lead to an upgrade.