The Dhaka Stock Exchange (DSE) extended its winning streak for the eighth consecutive week, driven by sustained investor interest in fundamentally strong blue-chip stocks. The benchmark DSEX index surged past the 5,400 mark, reaching a 10-month high — its best level since October 3, 2024.

Investor sentiment remained upbeat, buoyed by improving macroeconomic indicators such as robust foreign exchange reserves, a rise in export earnings, and record-high remittance inflows, according to market analysts.

A top stockbroker noted that institutional and foreign investors are increasingly shifting focus to fundamentally sound stocks, particularly banks and multinational companies. This renewed focus reflects long-overdue demand for quality equities, bolstered by regulatory steps toward improved corporate governance and a more stable currency market.

Additionally, positive developments in trade negotiations with the United States contributed to investor confidence. The recent decision by the US to revise down reciprocal tariffs on Bangladeshi imports to 20 percent — aligning the rate with peer economies — was seen as a partial relief for the country’s export sector, especially the ready-made garment (RMG) industry.

While the first three sessions of the week saw profit-booking pressure, market momentum regained strength in the final two sessions, propelling the index upward.

The DSEX index closed the week 51 points (0.95%) higher at 5,443, gaining a cumulative 805 points over the last eight weeks, with market capitalization increasing by Tk 617 billion to Tk 7.12 trillion.

In its weekly commentary, EBL Securities noted that heightened optimism around corporate earnings disclosures and portfolio rebalancing strategies drove strong buying activity, especially in the banking and pharma sectors.

Major contributors to the DSEX rally included Square Pharmaceuticals, Pubali Bank, Beximco Pharma, City Bank, and BRAC Bank, together adding nearly 48 points to the index.

The DS30 index, comprising 30 leading blue-chip companies, climbed 25 points to 2,114, while the DSES Index, which tracks Shariah-compliant stocks, edged down by 2 points to 1,171.

Turnover remained strong, with the week’s total reaching Tk 41.94 billion, only slightly lower than the Tk 42.97 billion posted the previous week. The final trading day of the week also recorded the highest single-day turnover in 11 months, surpassing the Tk 10 billion mark.

Average daily turnover stood at Tk 8.39 billion, a marginal 2.4 percent decline from the previous week’s average of Tk 8.6 billion.

By sector, banking led the turnover chart, accounting for 29.7 percent of the week’s total, followed by pharmaceuticals (10.3%) and textiles (8.5%). While banks, cement, and pharma stocks attracted increased investor interest, sectors like telecom, food, and power witnessed mild corrections.

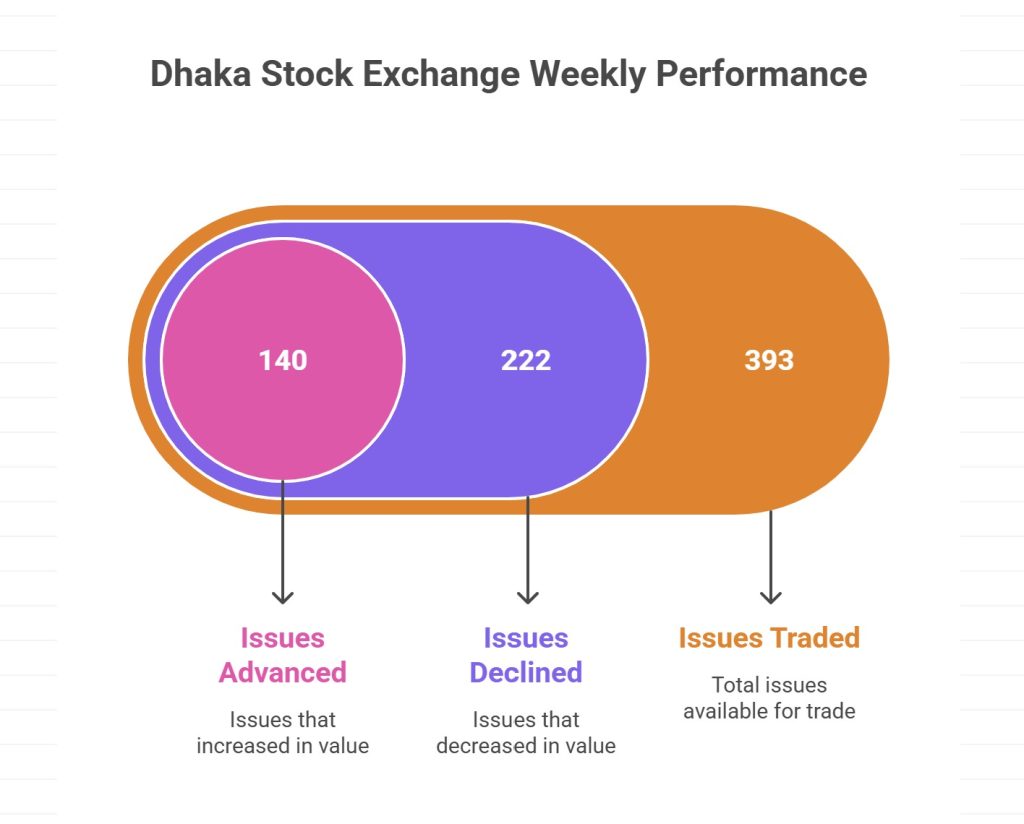

Of the 393 issues traded, 140 advanced, 222 declined, and 31 remained unchanged.

City Bank topped the weekly turnover list, with shares worth Tk 2.21 billion traded, followed by BRAC Bank, Bangladesh Shipping Corporation, BAT Bangladesh, and Jamuna Bank.

The Chittagong Stock Exchange (CSE) also ended the week on a positive note. Its All Share Price Index (CASPI) advanced 189 points to 15,202, while the Selective Categories Index (CSCX) gained 131 points, closing at 9,325.