Bangladesh had been grappling with a severe dollar crisis for the past few years, which significantly restricted businesses from opening Letters of Credit (LCs) as per their demand. Although the crisis has now eased and the supply of dollars currently exceeds demand, the surplus is not translating into tangible economic momentum. In an import-dependent country like Bangladesh, the trend of opening LCs continues to decline.

According to data from Bangladesh Bank, the total LC openings for imports increased by less than 1% in the recently concluded 2024–25 fiscal year. In FY 2023–24, LCs worth $68.89 billion were opened, while in FY 2024–25, it rose only slightly to $69.01 billion.

This stagnation persists despite the economy’s expanding needs, scale, and population. On average, Bangladesh needs to import goods worth $5 to $6 billion per month to meet normal economic demand. However, the momentum seen at the beginning of the last fiscal year could not be sustained. In June—the final month of the fiscal year—LC openings dropped to only $4.14 billion, the lowest in four and a half years. In contrast, June of FY 2023–24 saw LCs worth $5.47 billion, marking a 24.42% decline year-on-year.

Economists and banking officials attribute the slowdown in imports to declining investment, economic stagnation, and reduced consumer spending. Credit growth in the private sector has also dropped to just 6.40%. Due to a lack of new industrial ventures, imports of capital machinery have fallen sharply. Experts believe that increasing imports is essential to revitalize the economy.

Bangladesh Bank data shows that in FY 2024–25, LC openings for capital machinery—the backbone of industrial development—fell the most. In FY 2023–24, capital machinery LCs amounted to $2.34 billion, whereas in the last fiscal year, this dropped to $1.75 billion—a 25.41% decrease. Even in FY 2022–23, imports of capital machinery had declined by about 24%.

The second largest drop in LC openings was seen in intermediate goods for industries, which fell by 6.26%. Additionally, raw material LC openings dipped slightly by 0.15%. This indicates a downward trend in importing three key industrial inputs—capital machinery, intermediate goods, and raw materials—all of which are directly linked to GDP growth, employment, and export income.

Global fuel oil and LNG prices have been declining over the past 18 months, contributing to a 4.33% reduction in LCs for energy sector imports in the last fiscal year.

However, there was an increase in LCs for consumer goods (up 2.90%) and other miscellaneous products (up 5.63%) in FY 2024–25. Overall, total LC openings increased marginally by just 0.18% year-on-year, while LC settlements rose by 4.18%.

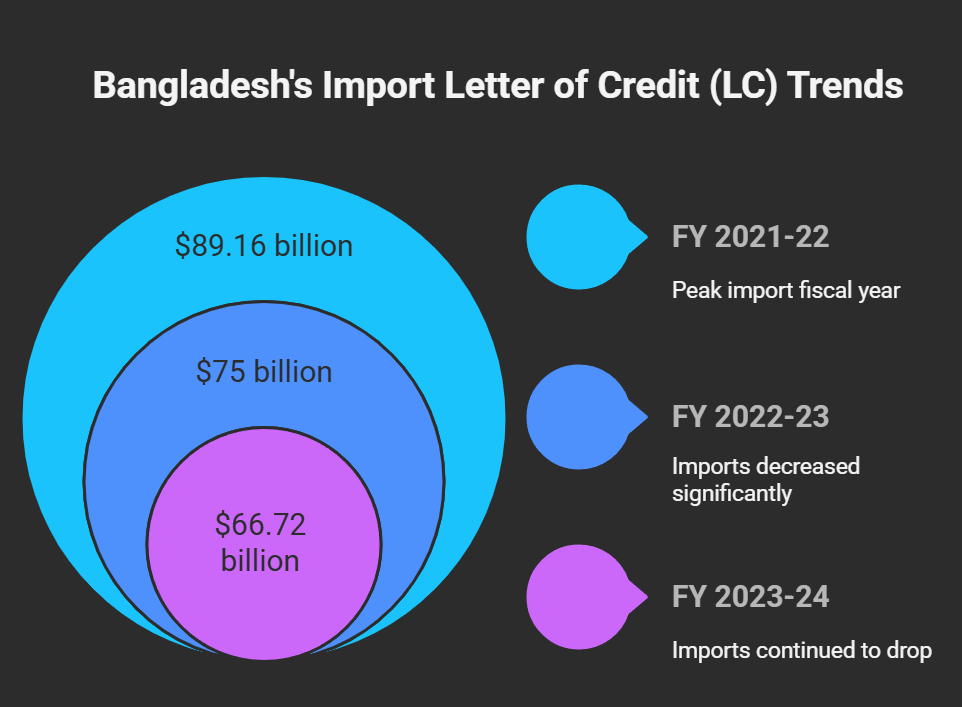

Bangladesh recorded its highest-ever imports in FY 2021–22, reaching $89.16 billion. However, the central bank later found evidence of capital flight masked as imports during that time. In FY 2022–23, imports fell by 15.81% to $75 billion, and further declined by another 11.11% in FY 2023–24, reaching $66.72 billion.