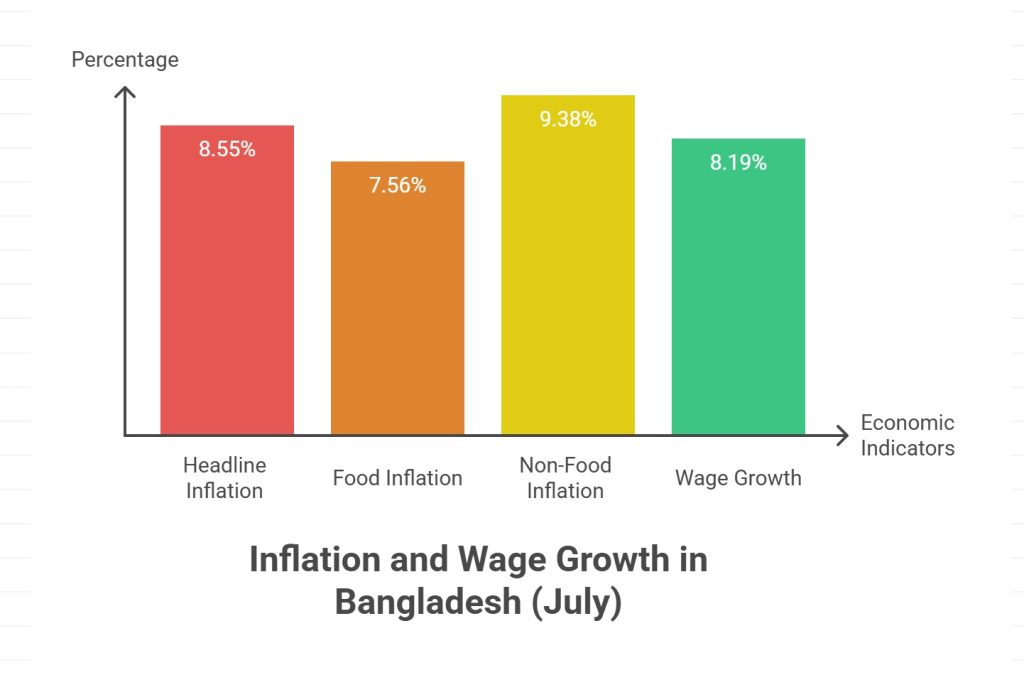

Bangladesh’s headline inflation edged up to 8.55 per cent in July, reversing a two-month decline and renewing concerns over cost-of-living pressures, according to the latest data from the Bangladesh Bureau of Statistics (BBS).

The monthly report titled “Consumer Price Index (CPI), Inflation Rate and Wage Rate Index (WRI) in Bangladesh”, released Thursday, shows a 0.07 percentage point increase from 8.48 per cent in June. The rise was driven primarily by a notable uptick in food inflation.

Food Inflation Pushes Overall CPI Higher

Food inflation rose to 7.56 per cent in July from 7.39 per cent in June—a 0.17 percentage point jump that accounted for the majority of the overall inflation increase, the BBS report noted.

Non-food inflation remained relatively stable, inching up slightly to 9.38 per cent from 9.37 per cent the previous month.

The inflation rate had been gradually easing after peaking at 9.35 per cent in May, but July’s data marks a reversal of that trend.

Rice and Fish Prices Behind Food Inflation Spike

The General Economics Division (GED) of the Planning Commission, in a recent report, flagged rice and fish as the primary drivers of food inflation. According to the GED, price increases in these two staples accounted for over 83 per cent of the food inflation rate.

The rising cost of essential food items has become a mounting concern for policymakers, particularly amid stagnant income growth.

Wage Growth Still Lags Behind Inflation

Wage growth in July stood at 8.19 per cent—up slightly from June—but it continued to trail the inflation rate for the 42nd consecutive month. Economists warn this persistent gap is eroding real incomes and deepening the cost-of-living crisis for low- and middle-income households.

Central Bank Eyes Inflation Target of 6.5%

In its latest monetary policy statement, the Bangladesh Bank reaffirmed its commitment to bringing inflation down to 6.5 per cent in the current fiscal year. The central bank has outlined a tighter monetary stance and other macroprudential measures to rein in consumer price pressures.

However, with global commodity prices and domestic supply disruptions remaining volatile, analysts say the inflation outlook remains uncertain.

“Achieving the 6.5% inflation target will require coordinated fiscal and monetary action, along with strong oversight on supply chain inefficiencies,” said a senior economist at a local think tank.

As food prices continue to strain household budgets and wage growth struggles to keep pace, the July inflation uptick serves as a stark reminder of the economic challenges ahead.