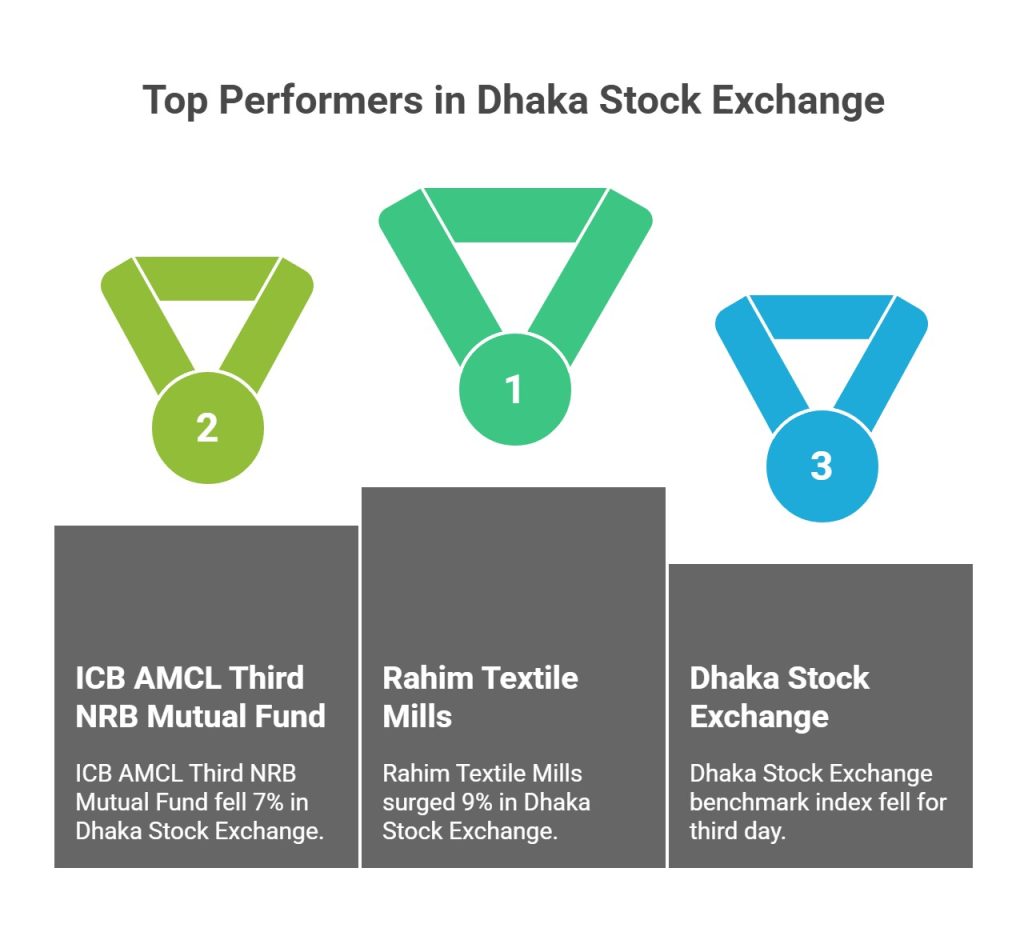

The Dhaka Stock Exchange (DSE) continued its downward momentum for the third consecutive session on Wednesday, as investors remained cautious amid a bearish sentiment across most sectors.

The benchmark index DSEX fell by 63.08 points, or 1.15 percent, to close at 5,408.07, marking another sharp decline after recent profit-booking activities.

Other key indices also followed suit. The DSES, which tracks Shariah-compliant stocks, slipped 1.14 percent to 1,170.43, while the DS30, comprising blue-chip stocks, shed 1.30 percent to close at 2,097.69.

Turnover Slows Further

Investor participation weakened, with total turnover falling to Tk 706.40 crore, down from Tk 889.95 crore in the previous session — indicating reduced buying interest amid market uncertainty.

A total of 212,827 trades were executed throughout the day, while block trades accounted for Tk 19.42 crore, involving 39 scrips.

Market Breadth Deeply Negative

The day’s trading reflected broad-based weakness:

- 79 stocks advanced

- 268 declined

- 51 remained unchanged

Among A-category stocks, 38 advanced, 165 declined, and 17 closed flat. The B-category posted 17 gainers against 58 losers. No trades were recorded in the N-category.

Sectoral and Instrument Performance

Performance across market segments remained mixed:

- Mutual funds: Only one issue advanced, while 25 declined.

- Corporate bonds: One issue closed higher.

- Government bonds: One gained and two lost ground.

Top Movers

- Gainer: Rahim Textile Mills led the day with a 9 percent rise, topping the gainers’ list.

- Loser: ICB AMCL Third NRB Mutual Fund was the worst performer, plunging by 7 percent.

Outlook

The ongoing correction reflects investor hesitation following recent rallies in key sectors such as banking and financials. Analysts note that without fresh catalysts or institutional support, the market may remain volatile in the short term.

Investors are now eyeing upcoming earnings disclosures and macroeconomic indicators for clearer signals on market direction.