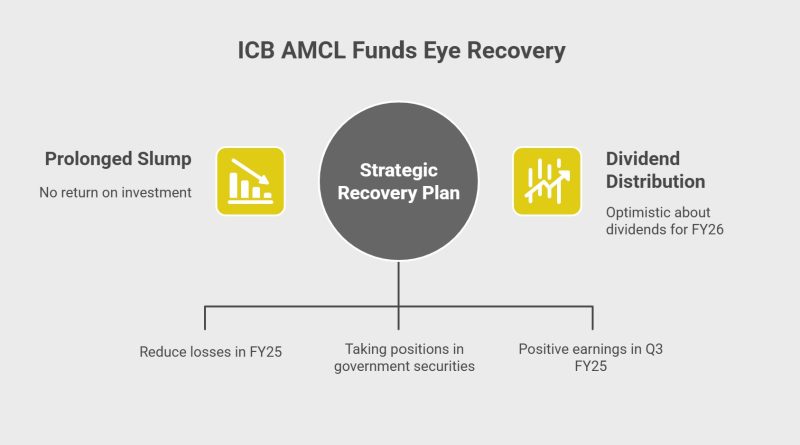

After two consecutive years of losses and no payouts, pooled funds managed by ICB Asset Management Company Ltd (ICB AMCL) are showing early signs of recovery, raising hopes for a dividend distribution in the 2025–26 fiscal year.

Unitholders received no returns in FY24, and FY25 is set to be equally disappointing, the company disclosed on Thursday. Persistent market declines and loss provisions prevented dividend payments, with the Dhaka Stock Exchange’s broad index dropping 502 points, or 9.4 per cent, to 4,838 in FY25, following a sharper 1,015-point fall the year before.

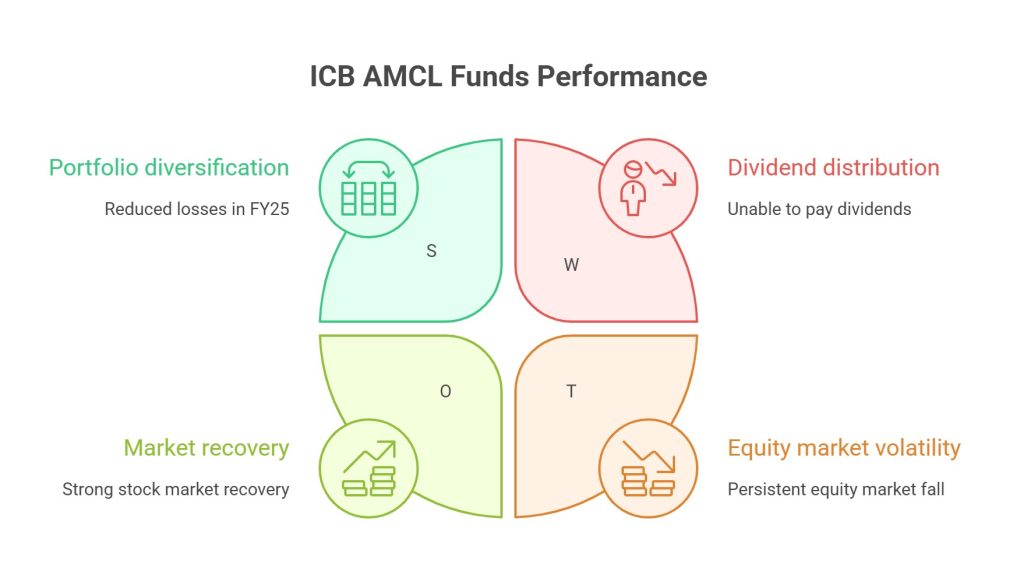

Some funds, however, saw notable improvements. The ICB AMCL 1st Agrani Bank Mutual Fund posted a profit of Tk 0.35 per unit in FY25, recovering from a Tk 1.69 loss per unit in FY24. Losses at the ICB AMCL Second Mutual Fund narrowed to Tk 0.15 per unit from Tk 1.86 per unit the previous year.

CEO Mahmuda Akhter attributed the turnaround to aggressive provisioning in FY24 and a shift in strategy. “We reshuffled portfolios and took positions in government securities, which reduced losses,” she said, adding that Q3 FY25 financials showed positive earnings for many funds.

Despite the progress, no dividends will be issued for FY25. However, Ms Akhter expressed confidence that payouts will resume in FY26, even if market conditions remain unchanged.

Recent stock market gains have further boosted optimism, with the DSEX climbing 16.62 per cent, or 771 points, to 5,408 between May 29 and August 7. ICB AMCL said its provision shortfall has fallen 24 per cent and the net asset value of its funds has risen 14 per cent during the rally.