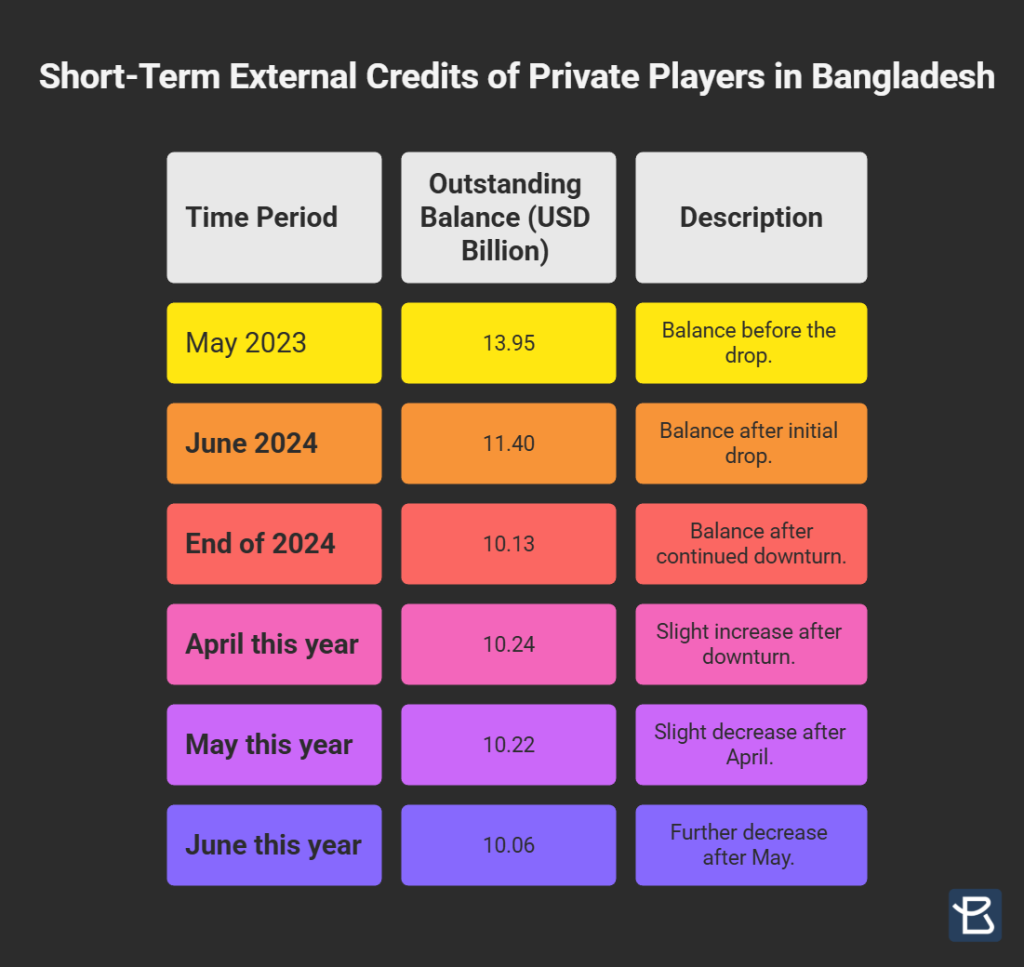

Corporate external borrowing continues to fall amid economic slowdown with the stock of short-term overseas debt having dropped to $10.06 billion in June last.

Officials and money-market analysts termed such continuous decline in private-sector foreign debt not a good sign for the private sector-led economy as interest rates on the global market stabilising and easing of import compression on the domestic market.

Apart from prevailing energy crisis facing the industrial hubs and depreciation of the local currency against the American greenback, the economic stalemate following recent mass uprising that led to the fall of the Sheikh Hasina regime in early August prompted the private entrepreneurs to be very conservative regarding expansion of their businesses, according to them.

According to the latest statistics of Bangladesh Bank (BB), the outstanding balance of short-term external credits taken by the private players was $13.95 billion even in May 2023. Thereafter it started dropping, having dropped to $11.40 billion in June, 2024.

The downturn continues to reach $10.13 billion by end of 2024 followed by $10.24 billion, $10.22 billion and $10.06 billion in April, May and June this year respectively.

In terms of creditor-country-wise short-term private external debts, Singapore topped the list with $1.89 billion followed by the Chine $0.94 billion, United Arab Emirates $0.93 billion, Hong Kong $0.84 billion, United Kingdom $0.81 billion and Germany $0.64 billion.

Seeking anonymity, a BB official said the fall in overseas debts would certainly relieve pressure on the forex reserves to some extent though the stock of foreign currencies continues to improve because of growing inflow of remittance and export receipts.

The central banker thinks the ruckus associated with the changeover in state power might prompt the private-sector players to be very careful as far as their business-expansion plans are concerned.

But the good part is that the country’s overall imports started increasing in very recent months, giving an early indication of economic rebound following months of sluggishness, the BB official added.

According to the latest data from Bangladesh Bank (BB), the opening of fresh LCs or letter of credits, generally known as import orders, increased to US$70.72 billion in the FY’25 from $68.77 billion recorded in the previous fiscal year (FY24).

In FY’23, the volume of import orders was worth $67.63 billion. The last fiscal year’s import orders were $1.95-billion higher from that of the FY’24.

The volume of settlements against the import orders climbed up to $71.14 billion in FY’25 from $66.07 billion recorded in FY’24.