Dhaka Stock Exchange’s (DSE) Z-category stocks, often labelled as “junk shares” due to their persistent losses and operational issues, have staged a surprising rally amid an otherwise subdued market.

These stocks, representing companies that have either ceased commercial operations for six consecutive months, failed to declare dividends for at least two years, or missed timely annual general meetings, have seen notable price gains despite weak or non-existent fundamentals.

On Tuesday, even as the main DSEX index declined for the sixth consecutive session, four of the top ten gainers were from the Z category. This trend raises concerns over continued market manipulation despite heightened regulatory scrutiny and tougher penalties imposed by the newly formed securities commission.

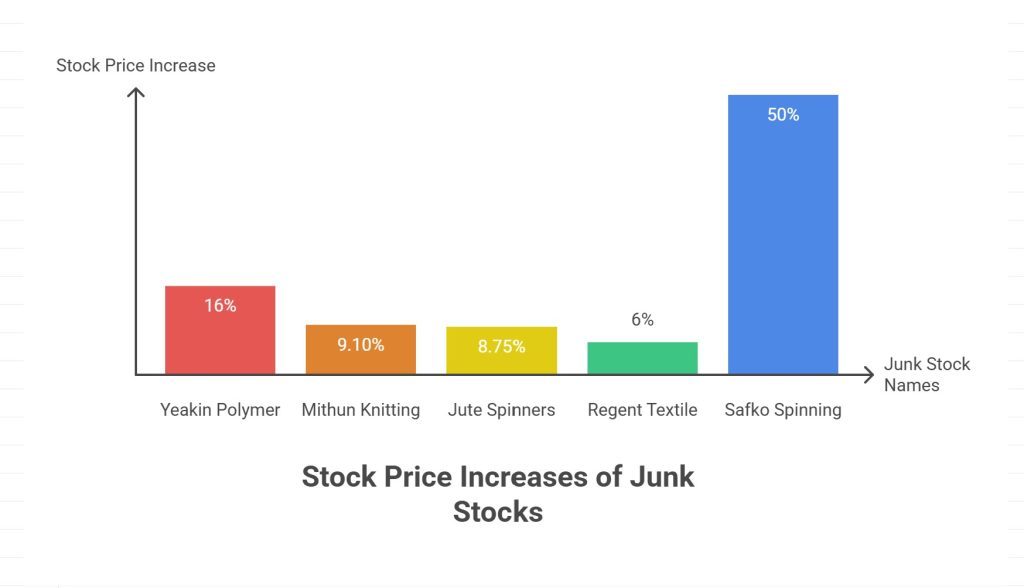

Analysts attribute the price surges to speculative trading and short-term profit-taking, rather than any fundamental business improvements. For instance, Yeakin Polymer’s stock soared 16% over three days, emerging as the top gainer on the DSE, despite reporting losses for four straight fiscal years and not declaring dividends since FY20. The company’s operations deteriorated rapidly after its 2016 IPO, with loan defaults reported by its auditors.

Remarkably, Yeakin Polymer’s share price jumped over 50% in the last two months without any corresponding disclosure of material information.

Similar patterns emerged in other troubled firms:

- Mithun Knitting climbed 9.10%,

- Jute Spinners rose 8.75%,

- Regent Textile gained 6%,

all while their business operations remain suspended.

Another distressed company, Safko Spinning, saw its shares rally nearly 50% in two months, despite its factory being shuttered for over a year.

“Price escalations of junk stocks are not possible without manipulation,” said Md Sajedul Islam, Managing Director of Shyamol Equity Management.

Meanwhile, cautious investors have preferred profit-taking, adopting a conservative stance ahead of the upcoming earnings and dividend season.

The broader market reflected the caution, with the DSEX index falling 28 points (0.53%) to 5,315, marking a loss of 221 points over five sessions. Market capitalization declined by Tk 67 billion during this period.

Other indices also weakened:

- DS30 dropped 15 points to 2,051,

- DSES (Shariah-compliant companies) fell 9 points to 1,152.

The Chittagong Stock Exchange also closed lower, with its CASPI index down 85 points to 14,940 and the CSCX index dropping 53 points to 9,164.