Bangladesh is witnessing a positive trend in remittance inflows this August. In just the first 17 days of the month, more than $1.5 billion (USD 1.619 billion) has been sent by expatriates. In local currency, this amounts to around Tk 19,642 crore (calculated at Tk 122 per dollar). If this momentum continues, remittances in August are expected to surpass those of July.

According to the latest Bangladesh Bank report, between 1–17 August, the country received USD 1.619 billion in remittances. Of this amount:

- State-owned banks channeled USD 493.3 million

- Specialized banks (including Bangladesh Krishi Bank alone with USD 150 million) handled a notable share

- Private banks accounted for USD 962.76 million

- Foreign banks brought in USD 3.13 million

In comparison, the first month of the current fiscal year (July 2025-26) saw remittance inflows of USD 2.479 billion, equivalent to nearly Tk 30,239 crore. However, during July, eight banks reported no remittance inflows, including state-owned Bangladesh Development Bank (BDBL) and Rajshahi Krishi Unnayan Bank (RAKUB). Among private banks, Community Bank, ICB Islamic Bank, and Padma Bank recorded no remittances, while in the foreign banking category, Habib Bank, National Bank of Pakistan, and State Bank of India also reported zero inflows.

The highest monthly remittance in recent history was recorded in March 2025, when the country received USD 3.29 billion—the largest in a single month. For the entire fiscal year 2024-25, Bangladesh received USD 30.33 billion in remittances, marking a 26.8% increase compared to the previous fiscal year.

In contrast, remittances in the fiscal year 2023-24 stood at USD 23.91 billion.

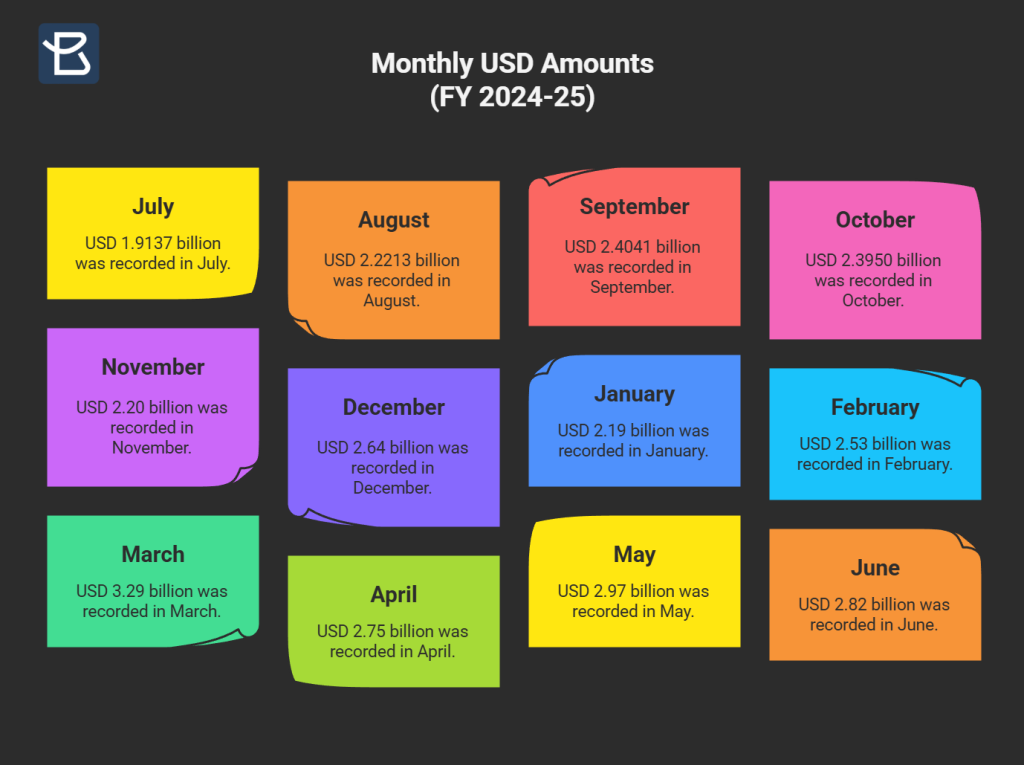

Monthly Remittance Inflows (FY 2024-25):

- July: USD 1.9137 billion

- August: USD 2.2213 billion

- September: USD 2.4041 billion

- October: USD 2.3950 billion

- November: USD 2.20 billion

- December: USD 2.64 billion

- January: USD 2.19 billion

- February: USD 2.53 billion

- March: USD 3.29 billion

- April: USD 2.75 billion

- May: USD 2.97 billion

- June: USD 2.82 billion

Analysts say government incentives and easier remittance channels have contributed to this sustained positive growth in expatriate income.