Bangladesh’s large manufacturing sector shrank 3.58 per cent year-on-year in June 2025, marking the second contraction in the last fiscal year, according to fresh data released by the Bangladesh Bureau of Statistics (BBS).

The setback came just a month after the sector had registered robust growth in May, underlining the fragile nature of industrial recovery amid domestic political turbulence and global trade uncertainty.

This is the second contraction in FY25, the previous one being in August 2024 when output declined 1.13 per cent as political unrest and nationwide blockades against the Hasina government disrupted economic activities. The former prime minister was ousted that month and later fled to India, deepening instability in the business climate.

Heavy Reliance on RMG Sector

The contraction was driven primarily by a decline in the ready-made garment (RMG) industry, which recorded a 6.55 per cent fall in output in June. Given that clothing and textiles together account for over 72 per cent of the manufacturing index weight, the sector’s downturn significantly influenced the overall industrial performance.

Textiles posted marginal growth—less than 1 per cent—during the month, insufficient to offset the RMG slump. The RMG and textile industries remain pivotal to the national economy, contributing over 11 per cent of GDP and providing jobs to more than five million workers.

Sector-Wise Breakdown

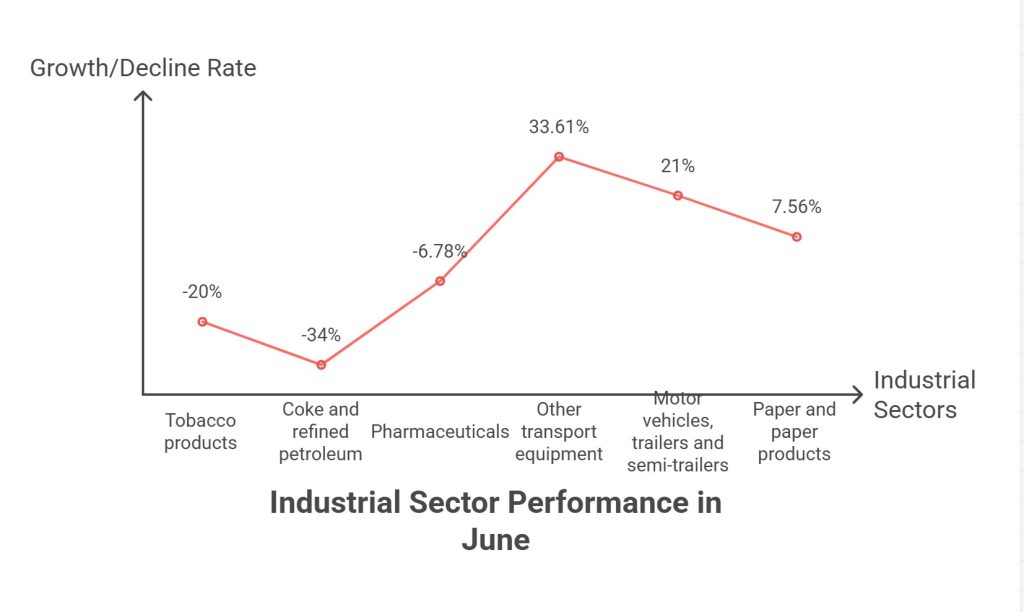

Out of the 23 industrial divisions, seven recorded contraction in June, while 16 showed growth.

- Sectors in decline:

- Tobacco products: down more than 20%

- Coke and refined petroleum: down 34%

- Pharmaceuticals: down 6.78%

- Sectors in expansion:

- Other transport equipment: up 33.61%

- Motor vehicles, trailers and semi-trailers: up 21%+

- Paper and paper products: up 7.56%

Global and Domestic Headwinds

Economists and manufacturers partly attribute the June contraction to uncertainties in global trade, including tariff measures introduced by U.S. President Donald Trump’s administration, which created volatility for Bangladeshi exporters across multiple sectors.

Dr. M. Masrur Reaz, Chairman and CEO of Policy Exchange Bangladesh, said the sector was still on a recovery trajectory despite the June setback.

“The Trump tariff made economic activities volatile,” he said, noting that Bangladesh is now positioned more favorably in global trade. “The forex market is stable, imports are rising, and domestic demand is strengthening.”

He, however, cautioned that inflationary pressures need to be addressed to create a more investment-friendly environment.

Outlook

While the June figures point to a slowdown, analysts believe the contraction may be temporary. With relative political stability restored after August’s turmoil and external demand showing early signs of recovery, manufacturing output is expected to pick up in the coming quarters, provided inflation is tamed and export competitiveness is preserved.