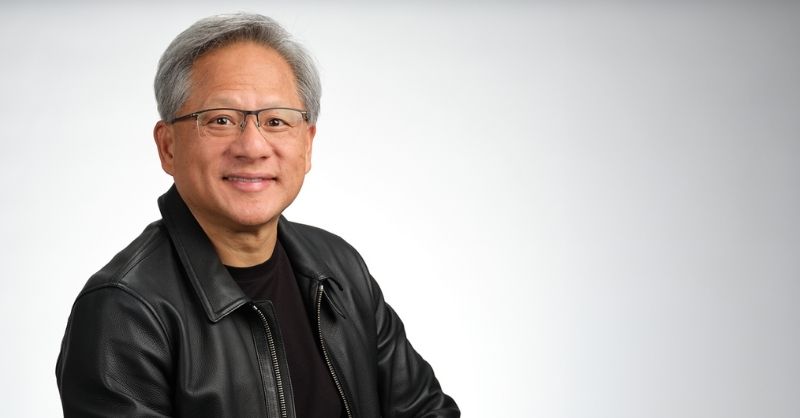

Nvidia CEO Jensen Huang on Wednesday dismissed concerns that the artificial intelligence spending spree is nearing an end, predicting the sector will expand into a $3–4 trillion market by 2030.

“A new industrial revolution has started. The AI race is on,” Huang said, emphasizing that demand for Nvidia chips remains stronger than supply. “The buzz is: everything sold out.”

His comments came after Nvidia forecast third-quarter revenue of around $54 billion, slightly above analyst expectations but short of sky-high investor hopes that have driven its stock up nearly 30% this year.

While some AI-focused stocks have shown signs of fatigue—and OpenAI CEO Sam Altman recently warned investors may be “overexcited”—Huang projected durability in AI spending. He pointed to $600 billion in data center capital expenditure this year from hyperscalers like Microsoft and Amazon, adding that Nvidia can capture as much as $35 billion from a single $60 billion facility.

Despite warnings of overheating, Nvidia’s dominance in the sector remains clear: its latest Blackwell and Hopper processors are largely booked through 2026, while even its scaled-down H20 chip for China secured a $650 million order outside the Chinese market.

Nvidia’s second-quarter net income has already outpaced Apple’s fiscal third-quarter profit, underscoring its position at the heart of the AI boom.

“When you have something this new, growing this fast, with huge capex commitments from hyperscalers, it’s evidence we’re still in the early stages,” said Thomas Martin, portfolio manager at Globalt Investments.