Bangladesh’s banking sector saw a reported improvement in capital adequacy for the January-March quarter, with the overall shortfall dropping nearly Tk62,000 crore to Tk1.10 lakh crore. However, the number of banks with deficits rose from 19 to 23, revealing that the apparent recovery masks deeper structural issues.

The decline comes as Bangladesh Bank allowed 28 banks to defer recognition of their capital shortfall, temporarily lowering the reported deficit. Among the new entrants into capital deficit are Premier Bank, Shimanto Bank, United Commercial Bank, and Citizen Bank.

Under banking regulations, a bank’s loans, advances, and investments are risk-weighted to determine minimum capital requirements. Government securities carry zero risk, while defaulted loans carry 100% weight. Experts say surging non-performing loans (NPLs) remain the main driver of capital shortfalls, as higher provisions reduce profits and erode retained earnings, the primary source of capital for most banks.

Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), said the deferral may have been necessary given the economic and political climate but stressed that banks must be closely monitored to prevent misuse. “This opportunity was given to increase the business stability of the banks,” she said.

Syed Mahbubur Rahman, CEO of Mutual Trust Bank, described the deferral as a temporary lifeline. “Otherwise, due to provisioning, net income would have turned negative and running the business would have become difficult,” he said, adding that without the measure, some foreign credit lines might have been cut.

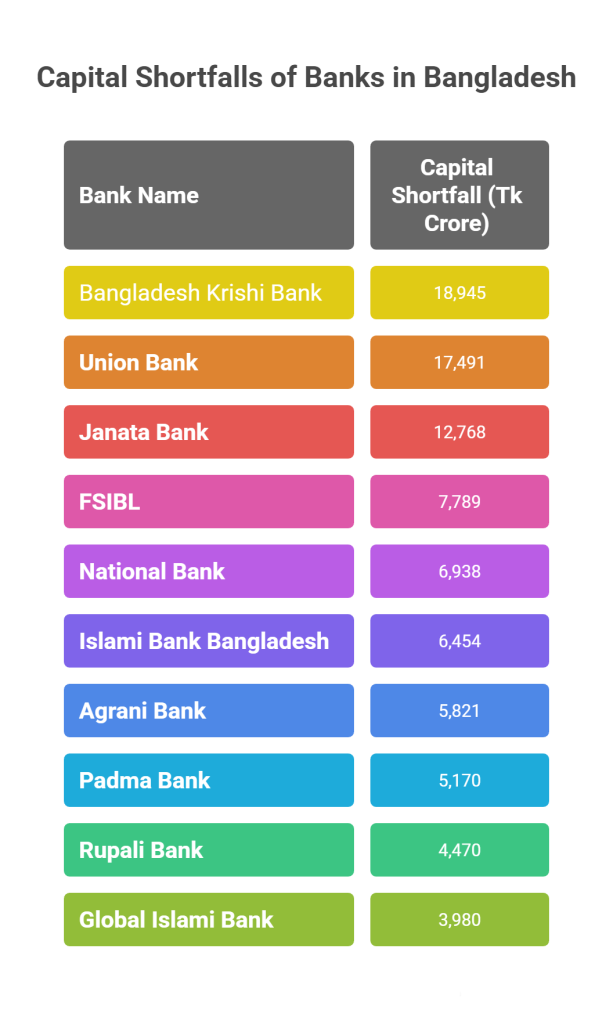

Banks with the highest shortfalls include Bangladesh Krishi Bank (Tk18,945 crore), Union Bank (Tk17,491 crore), and Janata Bank (Tk12,768 crore). Other notable lenders with deficits are FSIBL, National Bank, Islami Bank Bangladesh, Agrani Bank, Padma Bank, Rupali Bank, and Global Islami Bank.

Professor Mustafizur Rahman of CPD warned that the shortfall reflects long-standing provisioning against bad loans, previously hidden due to poor transparency. “There is no quick fix; solutions must come gradually through coordinated strategies,” he said, noting that steps such as improved monitoring, accountability, and potential mergers are underway to strengthen the sector.