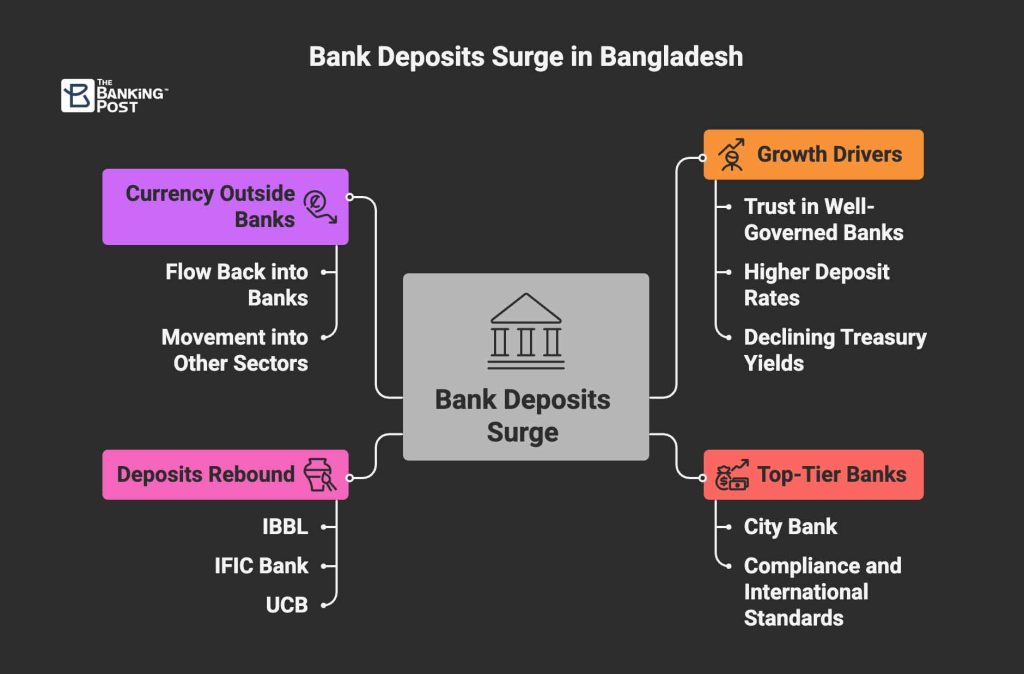

Bank deposits in Bangladesh grew 9.98% year-on-year in September 2025, marking the second-highest growth in the past 18 months, according to central bank data. The rise follows a 10.02% jump in August, signalling renewed confidence in the banking sector after more than a year of sluggish deposit growth.

Experts say the increase is driven by trust in well-governed banks, higher deposit rates compared to inflation, and falling yields on government securities, which prompted investors to move funds from treasury bills and bonds into bank accounts.

Top-tier banks saw the strongest growth as customers shifted funds from weaker lenders following last year’s political transition. Many depositors withdrew from banks perceived as unstable and returned to stronger institutions.

Mashrur Arefin, managing director of City Bank, said, “Deposits are increasing in well-managed banks because these institutions operate under proper guidance and regulation, which boosts public confidence. After the government changed, people withdrew money from weaker banks but are now returning to banks that follow compliance and international standards.”

Total deposits in the banking sector reached Tk19.14 lakh crore in September 2025, up from Tk17.41 lakh crore a year earlier. Interest rates on deposits, ranging from 8.5% to 9.5%, remain above September’s 8.36% inflation, further encouraging savings in banks.

Deposits rebound at IBBL, IFIC, UCB

Customer confidence is returning to Islami Bank Bangladesh Ltd (IBBL), IFIC Bank, and United Commercial Bank (UCB), which reported strong deposit growth in the past year.

- IBBL deposits rose 14.7%, reaching Tk179,579 crore from Tk156,564 crore.

- IFIC Bank deposits grew 12.6%, totaling Tk51,127 crore from Tk45,412 crore. Syed Mansur Mustafa, managing director of IFIC, said, “Our deposit base is expanding. Customers always received their money immediately, which strengthened confidence in our bank.”

- UCB deposits climbed from Tk54,439 crore to Tk65,524 crore, adding over Tk11,000 crore.

Currency outside banks declines

Meanwhile, currency held outside the banking system fell by Tk8,829 crore year-on-year, standing at Tk2.74 lakh crore in September 2025. Analysts say the money may have flowed back into banks, but part of it could also have moved into other sectors.

The central bank’s report suggests that strong governance, attractive deposit rates, and improved economic confidence are driving a slow but steady recovery in the formal banking system.