Bangladesh’s balance of payments (BoP) deficit eased in July, the first month of FY2025-26, as a current-account surplus and robust remittance inflows helped counter a steep fall in the financial account.

Bangladesh Bank data released Monday showed an overall BoP deficit of $545 million, down from $693 million a year earlier.

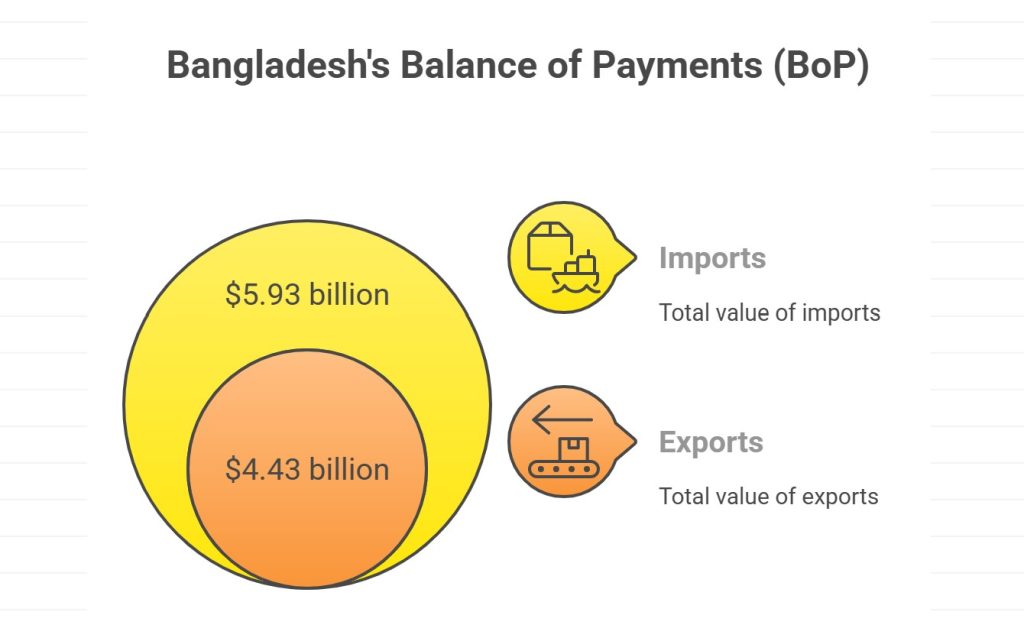

The current account swung to a $245 million surplus, reversing a $181 million deficit in July 2024. Exports jumped 27.1% year-on-year to $4.43 billion, led by a 24.7% rise in ready-made garment shipments to $3.96 billion. Imports also grew, though more moderately, by 19.9% to $5.93 billion.

Worker remittances surged nearly 30% to $2.48 billion, boosted by seasonal demand and continued use of formal banking channels amid stricter anti-hundi measures.

The financial account was the weak link, posting a $718 million deficit, compared with a $263 million surplus a year ago. Outflows in “other investments,” trade credits, and higher external loan repayments drove the slide.

While FDI doubled to $104 million, it remained small relative to the country’s financing needs, and portfolio inflows stayed subdued amid global and domestic concerns.

Economist Zahid Hussain called the picture “mixed”: strong receipts but persistent pressure on the financial account from capital outflows and debt servicing. He noted that imports of capital goods rose over 40% to $1.2 billion, suggesting early signs of a pickup in investment.