Dhaka, July 21, 2025 — Bangladesh’s overall imports rebounded in FY2024–25 following two consecutive years of contraction, but imports of capital machinery continued to decline for the third year in a row, signaling a persistent slump in industrial investment appetite.

According to the latest data from Bangladesh Bank, capital machinery imports, based on letters of credit (LCs) opened, dropped by 25 per cent year-on-year to $1.74 billion in FY25. Settlement of LCs also fell by the same margin, reflecting weak investor confidence and subdued demand for new industrial expansion.

Lack of Forward-Looking Investment

“This reflects a slowdown in both current and forward-looking investments,” said Dr. Mustafizur Rahman, Distinguished Fellow at the Centre for Policy Dialogue (CPD). “The ongoing decline highlights caution among entrepreneurs regarding future economic conditions.”

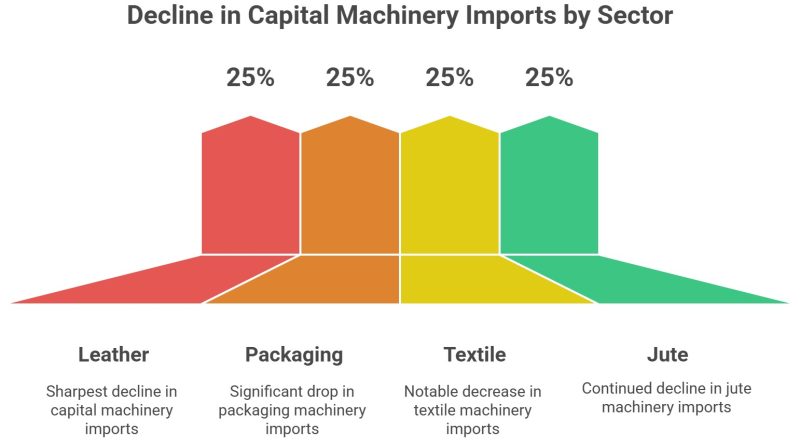

Bangladesh Bank data shows that the sharpest decline was observed in capital machinery imports for the leather sector, followed by the packaging, textile, and jute industries.

A key reason behind this investment slowdown is the contractionary monetary policy adopted by the central bank, which has kept private sector credit growth limited. In May 2025, credit growth stood at 7.15 per cent, well below the 9.5 per cent target.

Policy Uncertainty, FX Reserve Pressure Discourage Imports

Former BUILD Chairperson Asif Ibrahim noted that Bangladesh Bank’s efforts to manage declining foreign exchange reserves have played a crucial role in limiting capital machinery imports.

“As remittance inflows fluctuated and the trade deficit widened, the central bank had to prioritise essential imports—such as food, fuel, and medicine—while curbing non-essential and capital imports,” he said.

Administrative controls were tightened and LC approvals faced increased scrutiny, Ibrahim added. In response, many commercial banks imposed up to 100% cash margin requirements, significantly raising entry barriers for importers, particularly for SMEs.

Taka Depreciation and Rising Inflation Add Pressure

The sharp depreciation of the taka further inflated the cost of imports, compelling many businesses to delay or cancel import plans. At the same time, high domestic inflation and sluggish private sector lending further eroded demand across both industrial and consumer sectors.

On the supply side, local banks are grappling with liquidity constraints, while foreign correspondent banks have become increasingly cautious in confirming LCs due to concerns over Bangladesh’s sovereign credit risk, Ibrahim added.

Private Sector Holds Back Amid Political and Structural Concerns

Industry leaders also cited policy uncertainty, a lack of utility infrastructure, and weak governance as core reasons behind declining investment.

“The continued decline in LC openings points to a negative outlook for new investments,” said Mohammed Amirul Haque, Managing Director of Premier Cement Mills.

Mohammad Ali, Managing Director and CEO of Pubali Bank PLC, noted that entrepreneurs are adopting a “wait-and-see” approach amid political uncertainty and high borrowing costs. “Many investors are waiting for political stability and a decline in interest rates,” he said.

He added that a significant uptick in exports will be necessary to revive demand for capital machinery imports.

Macroeconomic Stability Comes at a Cost

Despite sectoral weaknesses, some indicators have shown improvement. Ashraf Ahmed, former President of the Dhaka Chamber of Commerce and Industry, acknowledged the positive effects of prudent monetary policy, including a narrowed trade deficit and stronger remittance inflows, driven by market-based exchange rate management.

“However, this stability has come at the cost of lower GDP growth, reduced private investment, and sluggish job creation,” he cautioned.

Outlook

While the overall import rebound signals a tentative economic recovery, the persistent decline in capital machinery imports highlights deeper structural concerns. Without stronger investor confidence, improved infrastructure, and a more predictable policy environment, Bangladesh’s industrial expansion may remain subdued in the near term.