Bangladesh’s payment ecosystem expanded sharply in 2024, supported by rising digital adoption, major system upgrades and stricter regulatory oversight, according to the Bangladesh Bank’s latest Payment Systems report.

Covering January–December 2024, the report details how both digital and non-digital transactions increased across platforms including BACPS, BEFTN, BD-RTGS, NPSB and the Interoperable Digital Transaction Platform (IDTP), alongside growing manual and mobile financial service (MFS) activity.

Digital transactions rise, non-digital grows even faster

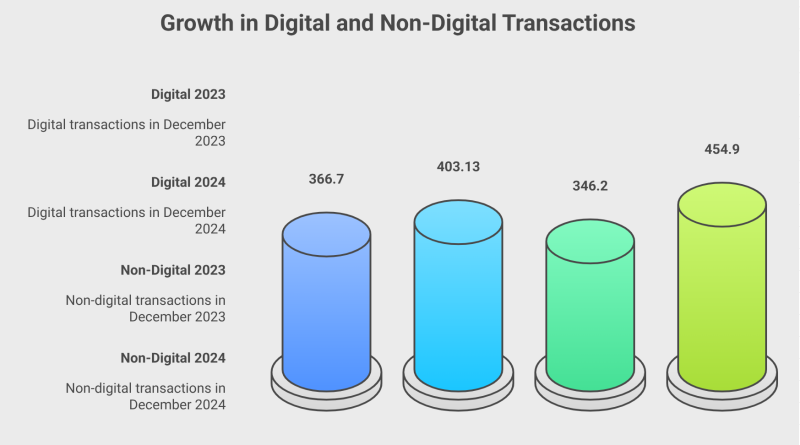

Digital transaction volume rose from 366.7 million in December 2023 to 403.13 million in December 2024. Total value increased to Tk 763.4 billion from Tk 751.4 billion.

Non-digital channels saw even stronger momentum, growing 31.4 per cent year-on-year to 454.9 million transactions.

Paper-based instruments under BACPS remained relevant, with 10.42 million cheques worth Tk 11.75 trillion cleared during the year.

Major upgrades in large-value systems

The BD-RTGS system underwent a significant overhaul in 2024, adopting ISO 20022 messaging standards, introducing separate settlement cycles for Taka and foreign currencies, strengthening tracking features and laying the groundwork for potential 24/7 availability.

The platform processed 5.39 million transactions worth Tk 26.72 trillion, reflecting increasing use of Taka and cross-currency settlements, including USD, EUR, CNY, JPY, GBP and CAD transfers.

Retail payments gain depth

Retail interoperability through NPSB expanded to over 154 million transactions worth more than Tk 2.71 billion. ATM withdrawals remained dominant, while POS and QR payments grew gradually.

The IDTP (Binimoy) platform gained traction after mid-2024 fee cuts and broader interoperability. By June, 481,000 users had created virtual identities. Throughout the year, it processed around 230,000 transactions worth nearly Tk 0.73 billion.

MFS usage softens

Despite overall digital growth, MFS transactions saw a decline in digital share. MFS digital usage fell from 46.82 per cent to 40.99 per cent of total volume, while value share edged down to 2.36 per cent.

In value terms, 32 per cent of MFS activity was cash-out, 30 per cent cash-in, 26 per cent P2P transfers, 5 per cent merchant payments and 3 per cent salary disbursements.

MFS providers’ float rose to Tk 131 billion, with active accounts climbing to 239 million. Agent numbers reached 1.8 million.

PSPs and PSOs also handled higher loads, processing 24.4 million and 35.1 million transactions respectively.

Uneven adoption across sectors

Industry stakeholders say the digital payment landscape is expanding but still imbalanced. While transfers through MFS platforms continue to grow, merchant-level adoption—especially among small and micro businesses—remains limited.

AKM Fahim Mashroor, CEO of bdjobs.com, said the banking system needs to become more SME-focused to accelerate financial inclusion. He noted that Bangladesh still lags behind countries like India in formal banking penetration.

He said growing transfers are encouraging, but merchant payments via MFS remain low. Micro-merchants, he added, should rely more on digital options for receiving payments and settling bills. Bank-based transfers to rural areas are also more cost-effective and should be promoted.

“MFS payments are still low, and this gap needs to be addressed,” he said.