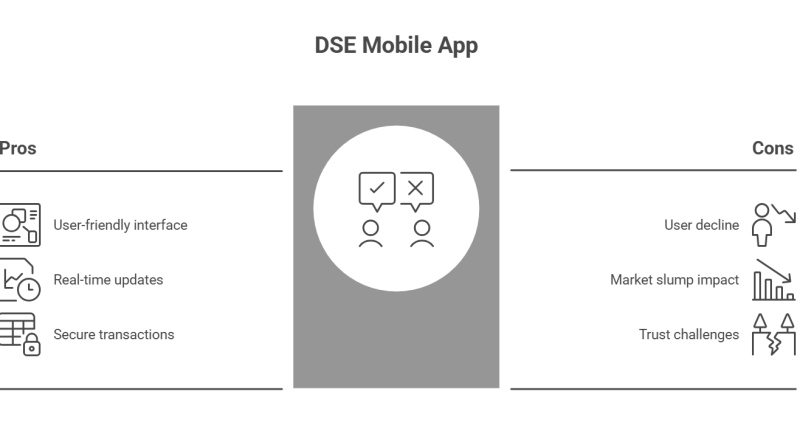

The number of active users of the Dhaka Stock Exchange (DSE) mobile trading app has plummeted to an eight-year low, reflecting investors’ growing disinterest amid a prolonged market downturn and the imposition of service charges.

At the end of FY25, active app users dropped to 26,067, a 21% decline from the previous year. In FY22, at the peak of a bullish market, users stood at 77,949. Since then, the downward market trend and growing macroeconomic challenges have triggered a continuous fall in user numbers.

Md Saiful Islam, president of the DSE Brokers Association of Bangladesh, attributed the decline to the extended bear run. “There has been little to no capital gain for investors in recent times. Many chose to exit the app and the market altogether,” he said.

The DSE’s benchmark index fell over 9% (490 points) in FY25, while average daily turnover slumped by 26% to Tk 4.72 billion.

Although the DSE app remained free until June 2023, a Tk 1,500 annual service charge was introduced for new users from July 2023, and for existing users from January 2024. While some blamed this fee for the exodus, Mr Saiful Islam noted, “If there were profits, the charge wouldn’t matter much.”

Md Sajedul Islam, managing director of Shyamol Equity Management, believes otherwise. “With losses in both the primary and secondary markets, investors are unwilling to pay for a service that no longer provides value.”

He added that many new investors are avoiding the market altogether, while existing ones are closing accounts. This trend is supported by a drop of over 100,000 beneficiary owner (BO) accounts in FY25.

A leading merchant banker, requesting anonymity, said the younger, tech-savvy demographic prefers app-based trading but has lost interest due to market stagnation. “It’s not just a drop in app users — it’s a broader market retreat.”

The economic landscape has been less than supportive. Lingering fallout from the pandemic, the Russia-Ukraine war, high inflation, and a flight of funds to high-yielding government securities have all weakened market confidence.

Hopes of recovery following political changes in August 2024 were short-lived, as fresh political uncertainties emerged, further discouraging investors.

Adding to the DSE app’s woes, several leading brokerage firms — including LankaBangla Securities, BRAC EPL, Shanta Securities, and Sheltech Brokerage — have rolled out their own proprietary trading apps, offering free, user-friendly alternatives.

“Clients of these firms no longer need the DSE app,” said a brokerage head. As a result, transactions through the DSE mobile app fell 24% year-on-year to Tk 161 billion in FY25.

A DSE official acknowledged that the decline in app-based trading mirrored the overall 26% drop in market turnover, which stood at Tk 1.11 trillion for the year.

Unless the market sees a significant recovery, experts say, both user interest and app engagement will likely remain muted.