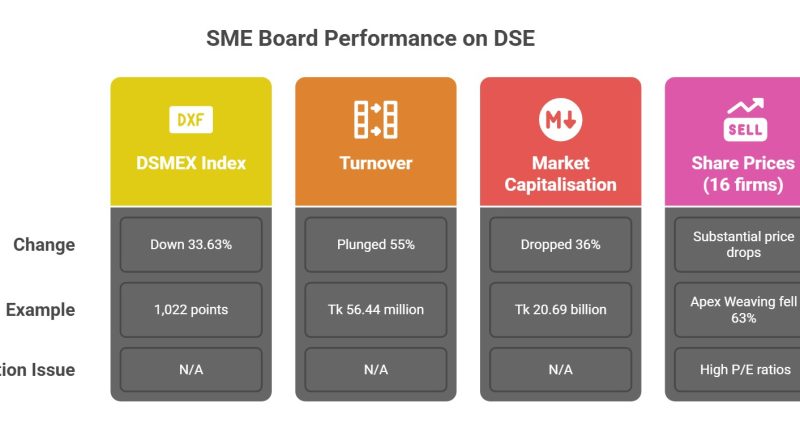

The SME board of the Dhaka Stock Exchange (DSE) has suffered a sharp decline over the past year, with both its index and turnover shrinking significantly due to steep corrections in share prices of listed firms.

As of Tuesday, the DSMEX index stood at 1,022 points, down 33.63% from 1,540 points recorded on July 16 last year—a drop of 518 points. Turnover also plunged by 55% year-on-year to Tk 56.44 million.

Launched in September 2021 to facilitate capital raising for small and medium enterprises, the SME platform has faced growing volatility since August 2024, exacerbated by liquidity constraints in the broader market.

Of the 20 companies currently listed, 16 saw substantial price drops. Apex Weaving’s shares fell 63%, from Tk 18.50 in April to Tk 6.90, while Himadri plunged 86% year-on-year to Tk 1,210.90.

Other notable losers include BD Paints, Krishibid Seed, Krishibid Feed, Master Feed Agrotec, and Mostafa Metal Industries.

Market capitalisation of the SME board has dropped 36% to Tk 20.69 billion as of July 16, 2025, from a year earlier. Daily trading volume also more than halved from Tk 124 million to Tk 56.44 million over the same period.

Despite these declines, analysts note that valuations remain high relative to earnings for several firms, discouraging investors. Himadri, for example, reported a P/E ratio of 354.06 with a market cap of Tk 3.52 billion, despite a modest profit of Tk 8.99 million in FY24.

Other overvalued firms include Yusuf Flour Mills (P/E 144.37) and Wonderland Toys (P/E 263.33), with the latter showing no profits since FY20, according to DSE disclosures.

Analysts warn that without stronger financial fundamentals and more realistic pricing, investor confidence in the SME board will remain subdued.