Bangladesh’s insurance sector is heavily concentrated in the hands of just five companies, raising concerns about competition and systemic risks, according to the central bank’s latest Financial Stability Report.

The report noted that the dominance of these firms has reduced competitiveness, created survival challenges for smaller insurers, and narrowed the diversity of products and services. The top players now control the bulk of assets and premiums in both life and non-life segments, leaving the entire sector vulnerable if even one faces trouble.

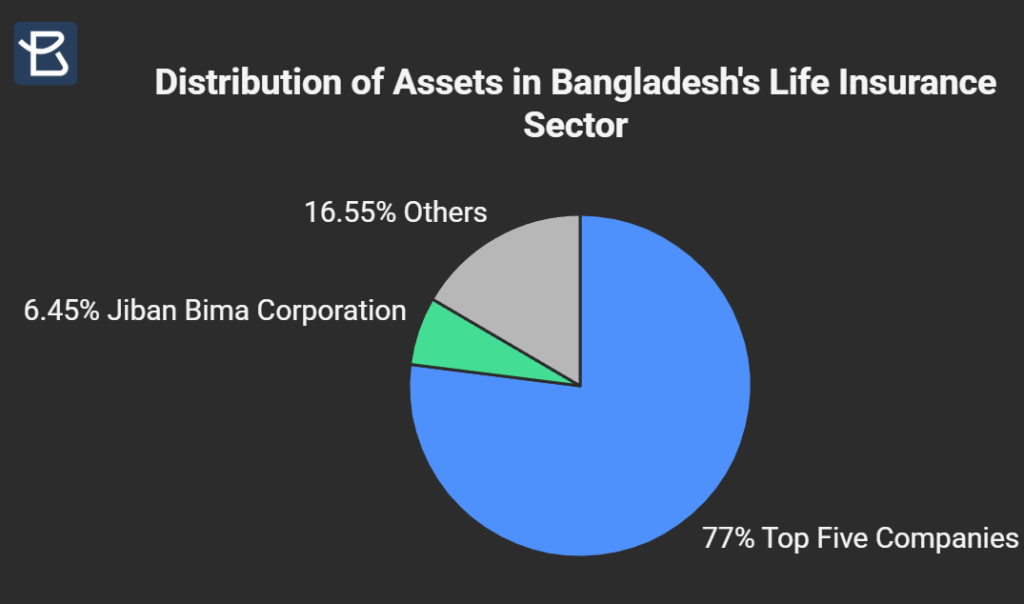

In the life insurance industry, total assets stood at Tk48,560 crore, of which 77% — or Tk37,357 crore — are controlled by the five largest companies. They also hold more than 65% of gross premiums. State-owned Jiban Bima Corporation alone accounts for 6.45% of assets and 7.01% of premiums.

In non-life insurance, assets total Tk20,530 crore, with the top five firms controlling 62.67% or Tk12,865 crore, along with 56.02% of premiums. Sadharan Bima Corporation dominates this segment, holding 42.17% of assets and 27.10% of premiums.

Bangladesh Bank cautioned that such high concentration of assets and premiums limits market competition and increases dependence on a handful of players.

The report also highlighted the sector’s deep linkages with the wider financial system, including banks, non-bank financial institutions, the capital market, and the bond market. Life insurers have invested around 63% of their funds in government securities. Investments in fixed deposits with banks and financial institutions fell to 13.25% in 2024 from 15.57% in 2023.

Since these deposits make up less than 1% of the banking sector’s total deposits, sudden withdrawals by insurers are unlikely to destabilise banks. However, any crisis in banks or NBFIs could severely affect insurers.

About 10.6% of insurance investments are in the stock market, where weak performance has directly hit sector earnings.