The government is set to bring a major structural reform to Bangladesh’s revenue administration by creating two separate divisions—Revenue Policy Division and Revenue Administration Division—aimed at streamlining policy formulation and administrative implementation. To facilitate this, the Revenue Policy and Revenue Management (Amendment) Ordinance, 2025 has been issued.

The initial draft of the ordinance underwent multiple consultations organized by the Advisory Council, with five rounds of discussions leading to revisions of certain clauses. The Cabinet sub-committee has already approved the proposal, and inter-ministerial feedback has been incorporated.

Key provisions of the ordinance include:

- Under Article 55(6) of the Constitution, the Prime Minister can divide a ministry into multiple divisions as needed.

- A high-level inter-ministerial committee, approved by the Prime Minister, will oversee the effectiveness of revenue policies and their monitoring.

- New rules and structures will be formulated under the Bangladesh Civil Service (Customs & Excise) Regulations, 1980.

- Audit and reporting of government asset usage and maintenance will be made mandatory, with annual submission of reports by relevant offices.

- The new structure proposes appointing two secretaries from the revenue cadre.

The ordinance is expected to be placed for approval at the Advisory Council meeting on Thursday.

NBR Abolished, Two New Divisions Established

According to official sources, the interim government has abolished the National Board of Revenue (NBR) and established the Revenue Policy Division and Revenue Administration Division under the Ministry of Finance. The ordinance was issued on May 12, 2025.

The government aims to separate revenue policy formulation from collection operations to enhance efficiency, reduce conflicts of interest, and broaden tax coverage.

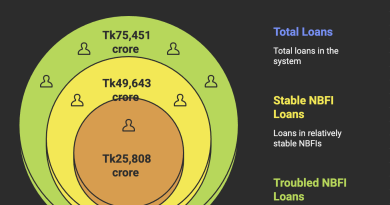

Over the past 50 years, the NBR has consistently fallen short of achieving revenue targets. Bangladesh’s tax-to-GDP ratio currently stands at 7.4%, the lowest in Asia, compared with a global average of 16.6% and 11.6% in Malaysia. Officials note that raising this ratio to at least 10% is essential for the country’s desired economic development.

Current Challenges in Revenue Administration

Under the existing setup, policy-making and implementation are housed within the same institution, creating several issues:

- Conflicts of interest between policy formulation and execution.

- Tax collectors operate with limited structural accountability.

- Measures against tax evasion are often delayed or ineffective.

- There is no objective performance indicator to evaluate tax collection efficiency.

Business leaders have long argued that a dedicated policy wing would ensure evidence-based and scientific revenue policy, a crucial factor in transitioning Bangladesh into a middle-income country. Separating policy from implementation, they say, would improve both accountability and efficiency, though human resource development will be critical.

Government officials expect that the reform will increase efficiency in the management and use of public assets, reduce irregularities and waste, improve fiscal discipline, and ensure optimal utilization of resources.