Bangladesh’s interim government has sharply reversed the country’s long-standing dependence on bank borrowing, opting instead to repay outstanding loans—an approach economists say could ease inflation and revive private-sector credit growth.

This marks a notable break from the previous administration, which had relied heavily on banks to finance its budget. In contrast, the new government is prioritising debt reduction, tighter spending and project rationalisation—an uncommon combination in recent fiscal history.

“The country’s economic landscape has seen a notable change over the last year, as the interim government is repaying its outstanding loans to the banking system,” said Mustafizur Rahman, distinguished fellow at the Centre for Policy Dialogue (CPD). According to him, banks are now reshaping their lending strategies after years of leaning on safe government loans.

He welcomed the decision to avoid fresh bank borrowing this fiscal year while reducing legacy debt, calling it evidence of fiscal discipline and “a more responsible pattern of public expenditure”.

Economist Abu Ahmed shared a similar view, saying that cutting spending—especially on “highly ambitious and unnecessary projects”—had become essential to restore balance in the credit market. He noted that earlier heavy government borrowing had crowded out private investment by encouraging banks to prioritise low-risk public lending.

“Banks got an opportunity to lend to the government, and they felt shy to invest in the private sector as there is a risk of recovery,” he said.

Debt Reversal

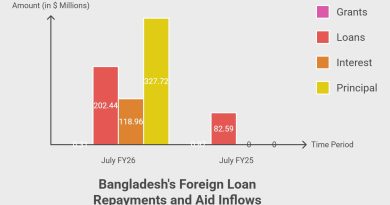

Data from the Bangladesh Bank points to a major shift. From July to October of FY2025–26, the government repaid Tk 503 crore to the banking system. In the same period last fiscal year, it had borrowed Tk 15,450 crore.

Net government debt with banks fell slightly from Tk 5,50,904.96 crore at the end of June to Tk 5,50,401.65 crore on 30 October. On that single day, repayments totalled nearly Tk 1,009 crore, driven mainly by clearance of short-term “Ways and Means Advance” obligations.

Non-Bank Funding Rises

At the same time, the government has leaned more on non-bank channels. Between July and October, it raised Tk 9,565.52 crore through treasury bills and bonds purchased by non-bank financial institutions, insurers and individual investors. Excluding National Savings Certificates, domestic borrowing from these sources stands at Tk 9,062 crore.

Economists say the fiscal tightening reflects a broader rethink of development priorities. Many non-essential or non-profitable projects have been cancelled, suspended or slowed, reducing the need for fresh debt. Stronger revenue collection has reinforced this shift.

Former National Board of Revenue chairman Dr Muhammad Abdul Mazid said higher-than-expected tax receipts in the first quarter had helped the government repay loans instead of taking new ones. “This strong revenue position, combined with the government’s firm stance on expenditure control, has made it possible to repay debt,” he said.

He added that lower government borrowing should ease inflation and expand banks’ lending capacity for businesses, potentially boosting production and employment.

Risks Ahead

While analysts broadly praise the government’s cautious fiscal stance, some warn that prolonged delays or downsizing of development projects could slow investment and weaken growth.

For now, however, Bangladesh’s banking sector is adjusting to a new reality—one where the government is no longer its biggest and safest borrower, and the private sector is once again poised to take centre stage in the credit market.