Growth in Bangladesh’s housing loan portfolio decelerated to 7.51% in the fiscal year 2023–24 (FY24), compared to 12.61% in the previous year, signaling a slowdown in credit expansion, according to the latest data from the Bangladesh Bank.

Despite the slower pace, the total outstanding volume of housing loans reached Tk 1.283 trillion by the end of FY24, underpinned primarily by the continued dominance of Private Commercial Banks (PCBs) in the mortgage finance market.

PCBs Lead Housing Finance Landscape

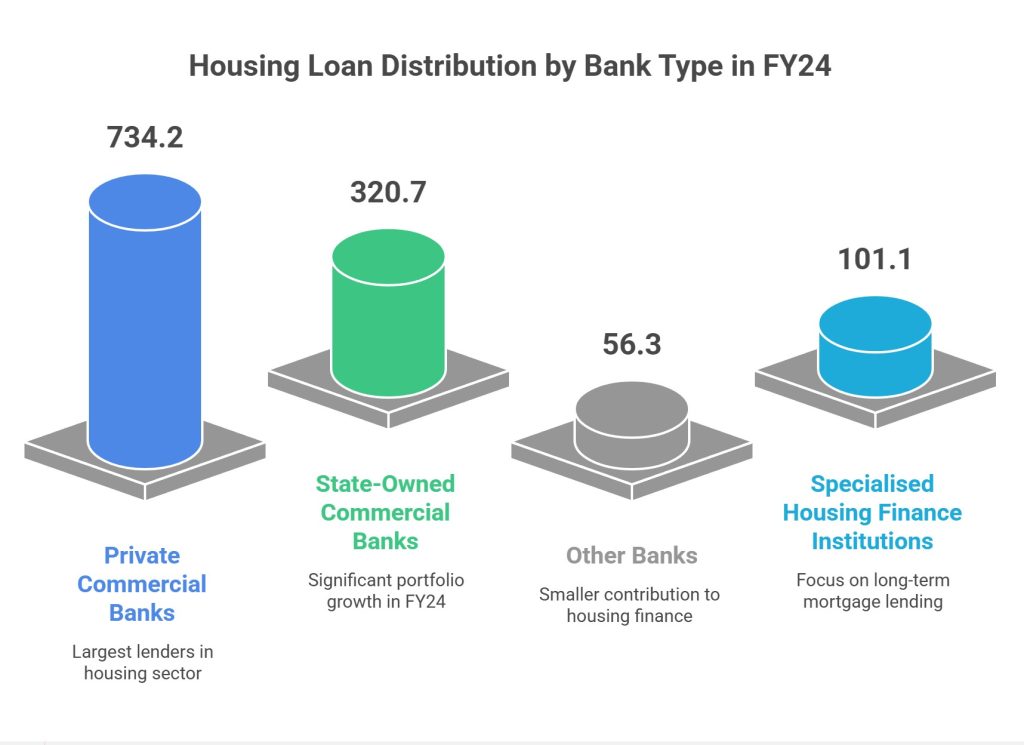

Private Commercial Banks remain the largest lenders in the housing sector, with outstanding loans rising to Tk 734.2 billion in FY24 from Tk 681.5 billion in FY23. Their vast deposit base and proactive loan disbursement strategies have cemented their lead in housing finance.

State-Owned Commercial Banks (SCBs) followed with a housing loan portfolio of Tk 320.7 billion, up from Tk 293.8 billion the previous fiscal year. Other banks accounted for Tk 56.3 billion in home loans during the same period.

Specialised housing finance institutions—focused on long-term deposits and mortgage lending—contributed another Tk 101.1 billion. Among them, the Bangladesh House Building Finance Corporation (BHBFC), the country’s only state-owned housing finance entity, had Tk 48.0 billion in outstanding loans as of June 2024. BHBFC operates largely through government-provided paid-up capital.

Demand Grows, but Structural Barriers Persist

The sustained expansion in total loan volume reflects increasing demand for home ownership, particularly in urban and semi-urban areas. However, housing loans still constitute a relatively modest share of total private sector credit, suggesting considerable room for future growth.

Liakat Ali Bhuiyan, Vice President of the Real Estate and Housing Association of Bangladesh (REHAB), attributed the rise in home loans to improved access and faster disbursement by banks.

“Banks are now processing housing loans more efficiently and with greater ease, which has likely contributed to the increase in outstanding loans,” Bhuiyan said.

However, he highlighted that the 2022 Detailed Area Plan (DAP) remains a major hurdle for the real estate sector.

“The DAP has created significant bottlenecks by limiting building heights, discouraging landowners from providing land to developers. This has disrupted over 200 linked industries,” he noted.

REHAB has previously urged the government to revise the DAP to revive momentum in the housing and construction sectors.

Experts Call for Regulatory Reform

Dr Masrur Reaz, Chairman and CEO of Policy Exchange Bangladesh, described the slowdown in housing loan growth as a reflection of both cautious lending behavior and structural constraints in the market.

“The 7.51% growth in FY24, down from 12.05% in FY23, highlights a tightening environment for housing finance,” Dr Reaz said. “While the Tk 1.28 trillion in outstanding loans shows rising urban housing demand, policy and market barriers continue to restrict broader credit access.”

He called for regulatory and urban planning reforms to reinvigorate the sector.

“Planning measures like the DAP are having an unintended cooling effect. Revisiting these frameworks could help restore investor confidence and attract greater private capital,” Dr Reaz added. “Bangladesh needs more strategic, demand-driven financing models to ensure affordable housing and sustain long-term sectoral growth.”