The Investment Corporation of Bangladesh (ICB) is seeking fresh government funds to overcome its liquidity crisis and return to profitability after years of financial strain.

The state-owned investment bank, heavily reliant on the secondary market for revenue, reported a 90% year-on-year rise in capital gains to Tk 2.02 billion in the nine months through March this year. However, this recovery was overshadowed by a loss of Tk 2.79 billion during the same period, driven mainly by interest payments of Tk 6.98 billion.

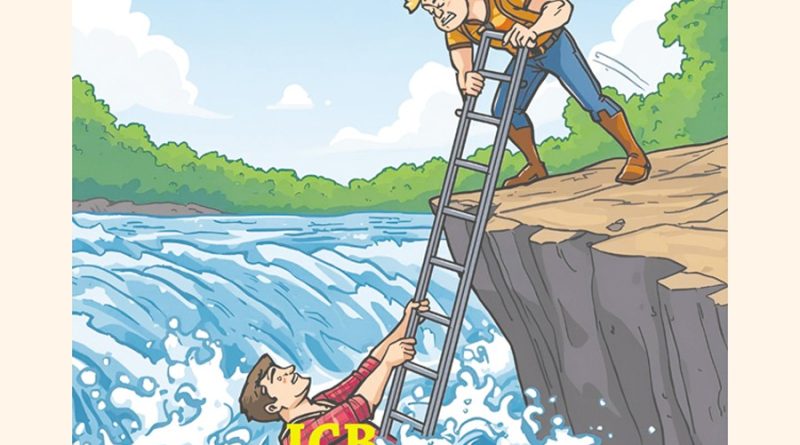

To climb out of losses, ICB urgently needs funds to repay its high-interest loans.

A senior ICB official said the previous board had drawn up a five-year recovery plan requiring Tk 50 billion in low-cost funds. “If the government had provided the full amount earlier, ICB would have been on track to recovery,” the official said.

Last December, the government injected Tk 30 billion into the corporation, of which Tk 20 billion was used to repay expensive loans and the rest was invested in the stock market.

Now, the government is considering an additional Tk 10 billion from the revised national budget to ease ICB’s liquidity pressure and stabilise the capital market.

ICB Chairman Prof Abu Ahmed said the institution could recover fully if it receives proper and timely support. “You can see from our financial statement — capital gains have risen because of the government’s low-cost fund last year. The faster we get the fresh funds, the quicker we’ll recover,” he said, adding that at least Tk 20 billion is needed immediately.

ICB has long played a key role in supporting market stability, often investing borrowed funds to prevent market collapse. After the 2010 stock market crash, it took on high-interest loans to prop up share prices — a move that deepened its financial woes over time.

The corporation also suffered losses from poor investment decisions and currently has fixed deposits worth over Tk 9.2 billion stuck in weak and scam-hit non-bank financial institutions, generating no returns.

ICB once stood as a strong performer, earning a record Tk 5 billion profit in 2011. But its fortunes declined in the following years due to a sluggish market, high borrowing costs, and overreliance on stock market income.

To regain its strength, ICB sought Tk 50 billion from the government in May last year to repay high-cost loans and inject liquidity into the capital market.

Among its subsidiaries, ICB Securities Trading Company continues trading on behalf of investors and managing its own portfolio, but ICB Asset Management Company and ICB Capital Management have struggled to meet earnings expectations amid the prolonged market downturn.