IDLC Finance Limited, a leading non-bank financial institution (NBFI) in Bangladesh, posted a 45 per cent year-on-year increase in net profit for the second quarter of 2025, driven primarily by substantial gains from investments in government securities.

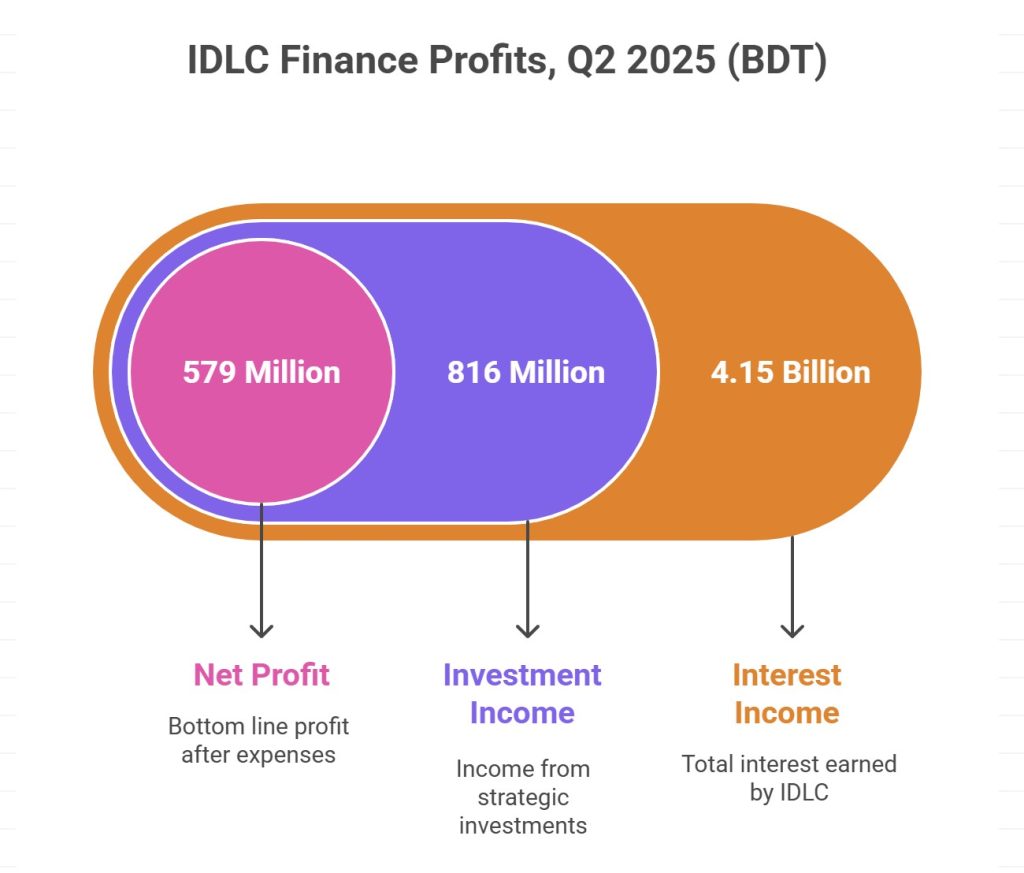

According to its unaudited financial statements released on Thursday, IDLC reported a net profit of Tk 579 million for the April–June period, up from Tk 398 million in the same quarter of the previous year. As a result, its consolidated earnings per share (EPS) rose to Tk 1.33, compared to Tk 0.91 a year earlier.

While the company’s core net interest income declined by 20 per cent to Tk 1.02 billion, owing to a sharp 30 per cent rise in interest payments to depositors, the overall profit was buoyed by a fivefold increase in investment income, which jumped to Tk 816 million in Q2.

Total interest income grew by 13 per cent to Tk 4.15 billion, but rising costs on deposits due to tightening liquidity and inflationary pressures weighed on the core lending business. Still, the gains from government securities significantly offset this impact, allowing the institution to post strong quarterly results.

Industry insiders noted that despite a challenging macroeconomic environment marked by persistent inflation, financially sound institutions like IDLC managed to capitalize on strategic investments to drive profitability.

For the first half (January–June) of the year, IDLC’s consolidated net profit also increased by 45 per cent year-on-year to Tk 1.09 billion, compared to Tk 752 million in the same period of 2024. The net operating cash flow per share rose sharply to Tk 20.31, up from Tk 6.49, reflecting a strong improvement in operational cash generation.

The company’s net asset value (NAV) stood at Tk 36.44 per share as of June 2025, compared to Tk 35.83 in December 2024, indicating an improvement in overall financial strength.

Listed on the Dhaka Stock Exchange since 1992, IDLC’s share price rose 1.68 per cent on Thursday to Tk 42.40, capping off a remarkable 47 per cent gain over the past month, reflecting growing investor confidence in the company’s fundamentals.