To boost popularity and inclusivity, the National Pension Authority is preparing to launch Islamic versions of its four existing universal pension schemes—Probash (expatriate), Pragoti (private sector), Surakkha (informal sector), and Samata (low-income segment). Funded by the Asian Development Bank (ADB), an international consultant has already been appointed to lead this initiative.

In addition to introducing Shariah-compliant schemes, efforts are underway to integrate insurance benefits and expand pension coverage to bank employees and MPO-listed teachers and staff.

Officials say a significant number of religiously observant citizens have refrained from joining the pension schemes due to the absence of Islamic options. The lack of Shariah-based models has also limited outreach through mosque networks. The authority hopes that adding Islamic versions to each scheme will substantially increase enrollment.

Gholam Mostafa, a member of the National Pension Authority, emphasized the need for Bangladesh Bank’s cooperation to include bank staff in the schemes. “We’ve requested their involvement and will reach out again if needed,” he noted.

Another official, speaking anonymously, stressed that in a Muslim-majority country, many citizens prefer Shariah-compliant financial models. Without an Islamic version, registrations have lagged. The proposal to launch Islamic alternatives will be presented at the next board meeting following a detailed study led by the international consultant.

The reforms also include efforts to:

- 🎓 Integrate MPO-listed teachers into the scheme through an inter-ministerial committee formed in April.

- 🌐 Join the International Social Security Association (ISSA) as an affiliated member, with a proposed annual fee of CHF 15,680 (about Tk 2 million), payable within six months of membership approval.

📱 Upcoming Mobile App

Recognizing the need for tech-friendly access, the National Pension Authority has developed a mobile application for pension subscribers. Currently ready for use, it is expected to be launched soon to simplify registration and payments.

💼 Bank and Private Sector Integration

The Pragoti scheme is expected to attract bank officials and private sector employees. Authorities have requested Bangladesh Bank to take prompt steps in facilitating employee enrollment.

When asked about timelines, Mostafa said, “We’re working on the Islamic version and insurance integration, though it will take time.”

📊 Current Enrollment Landscape

Since launching on 17 August 2023, four schemes have become active: Probash, Pragoti, Surakkha, and Samata. A fifth scheme, Prottoy, was announced for government agencies but later canceled due to teachers’ protests.

While initial response was strong, momentum dipped temporarily before rising again in April. By April 2024, total registrations crossed 100,000, eventually reaching over 350,000 by July—accumulating roughly Tk 1 billion in contributions.

However, registration slowed dramatically following the resignation of Prime Minister Sheikh Hasina amid student-led protests in August. As of 9 June 2025, the number of subscribers reached 374,057, with Tk 1.89 billion in total deposits. Only 2,117 new registrations were made in the last 10 months.

Despite the slowdown, low-income individuals remain the most active participants. Under Samata—designed for those earning less than Tk 60,000 per year—77% of all registrants are enrolled. As of 9 July, 286,315 people had joined the scheme, depositing Tk 476.7 million.

Among the remaining schemes:

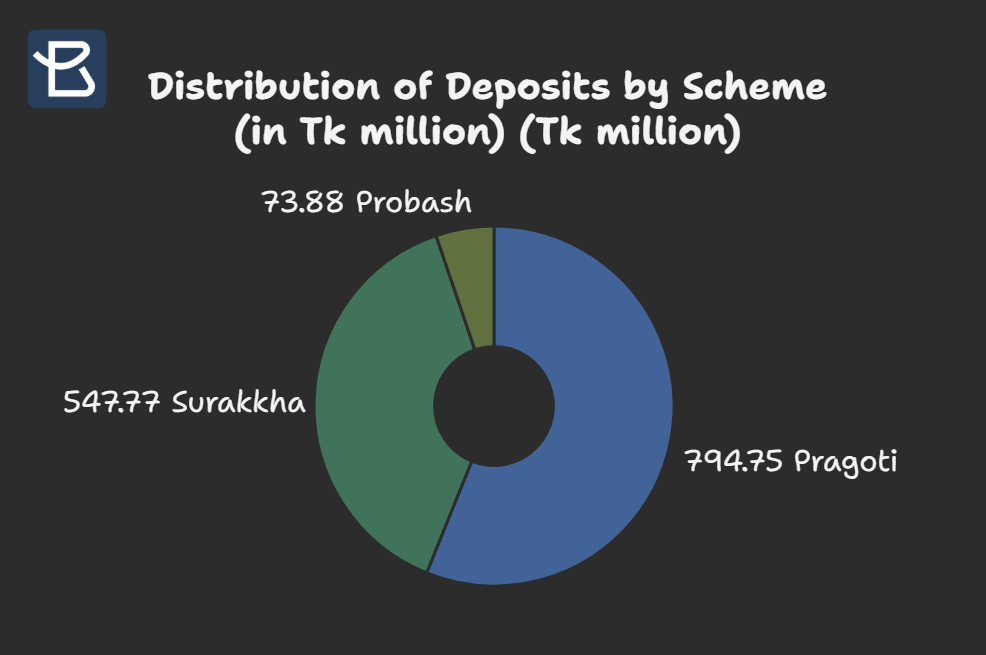

- 👔 Pragoti: 23,278 private sector employees, Tk 794.75 million in deposits

- 🛠️ Surakkha: 63,624 informal workers (e.g., farmers, rickshaw drivers, potters, fishermen), Tk 547.77 million in deposits

- 🌍 Probash: Just 994 expatriates, Tk 73.88 million deposited