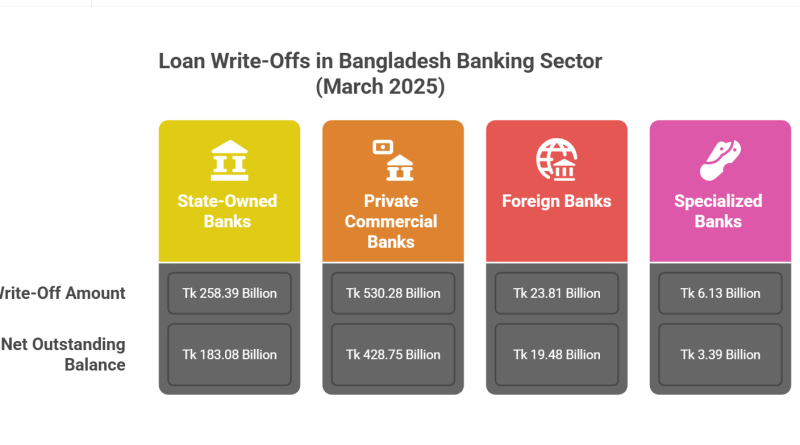

Dhaka, July 12 — The total amount of written-off loans in Bangladesh’s banking sector surged to over Tk 818.63 billion as of March 2025, according to the latest figures released by the Bangladesh Bank.

State-owned commercial banks accounted for a significant share, writing off Tk 258.39 billion in loans. Private commercial banks followed, reporting write-offs of Tk 530.28 billion. Foreign banks and specialized banks wrote off Tk 23.81 billion and Tk 6.13 billion respectively.

The net outstanding balance of these written-off loans stood at Tk 634.71 billion, with private commercial banks retaining the highest portion at Tk 428.75 billion. State-owned banks reported Tk 183.08 billion, foreign banks Tk 19.48 billion, and specialized banks Tk 3.39 billion.

According to banking norms, loans may be written off when recovery becomes implausible due to prolonged default or structural risks. The practice helps banks clean their balance sheets, although institutions are mandated to maintain full provisioning and proper ledger records as per central bank guidelines.

However, economists and industry experts have flagged concerns over the continued growth in loan write-offs. Many fear the approach may obscure the actual size of non-performing loans (NPLs) and erode discipline in the credit system.

“Loan write-offs are expected to rise further as NPLs continue to grow,” said M Masrur Reaz, Chairman of Policy Exchange Bangladesh. “Asset management firms may play a bigger role in restructuring troubled banks, but strong governance, strict risk control, and vigilant regulatory oversight remain critical.”

Stakeholders also pointed out that loans lost to fraud or major irregularities—often classified as unrecoverable—make up a sizable portion of the write-offs. These cases, they argue, illustrate systemic weaknesses in loan approval and monitoring processes.

Experts suggest that restoring transparency and accountability in the financial sector is key to reversing the trend and protecting investor confidence.