Dhaka, July 17 —

Despite years of policy pledges for diversification, Bangladesh’s non-readymade garment (non-RMG) exports have seen virtually no growth in their share of total export earnings over the past decade, highlighting the country’s continued overdependence on the textile and RMG sector.

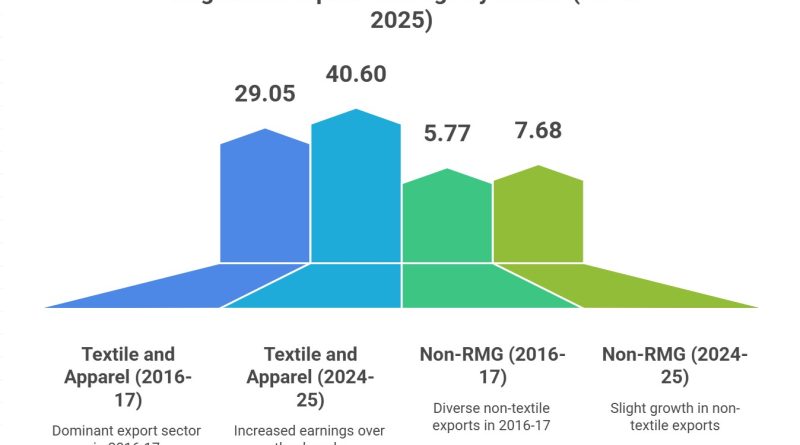

According to the latest data from the Export Promotion Bureau (EPB), non-RMG exports contributed 15.91% to total export earnings in the fiscal year 2024–25, a marginal decline from 16.59% recorded in FY 2016–17. In contrast, the RMG and textile sector accounted for 84.08% of Bangladesh’s $48.28 billion in total merchandise exports in the just-concluded fiscal year, up from 83.4% in FY17.

Of the $48.28 billion in exports, RMG and textile fetched $40.60 billion, including $38.23 billion from RMG alone, while non-RMG items brought in just $7.68 billion.

Non-RMG Sectors Face Structural Challenges

The static performance of non-RMG sectors—such as leather, jute, frozen fish, agro-products, and engineering goods—suggests that efforts to diversify Bangladesh’s export base have not translated into tangible outcomes.

Tariqul Islam Zaheer, Managing Director of Achia Sea Foods Ltd, said the shrimp industry has suffered a continuous decline due to structural weaknesses. “The sector lacks raw materials, suffers from low productivity, and faces fierce global competition,” he said, citing the outdated farming methods that yield only 350–500 kg of shrimp per hectare—the lowest globally. Competing nations like India, Vietnam, and Indonesia produce up to 12,000 kg per hectare of high-yield vannamei shrimp.

As a result, shrimp processing units in Bangladesh have drastically reduced. “Five years ago, 112 plants were operational; today, only 20 to 25 remain,” said Zaheer, who also serves as a Senior Vice President at the Bangladesh Frozen Foods Exporters Association (BFFEA).

EPB figures show frozen fish exports declined from $526.45 million in FY17 to $441.58 million in FY25.

Leather, Jute Also on the Decline

Other non-RMG sectors are experiencing similar stagnation or contraction. Leather and leather goods fetched $1.14 billion in FY25, down from $1.23 billion in FY17, while jute and jute goods declined from $1.02 billion in FY18 to $820.16 million in FY25.

Md Abul Hossain, Chairman of the Bangladesh Jute Mills Association (BJMA), attributed the drop in jute exports to lower production, driven by poor fiber prices for farmers, reduced government incentives, and rising competition from synthetic alternatives. “India’s anti-dumping duty on Bangladeshi jute has also hurt export volumes,” he added.

Agricultural Exports: Growth with Volatility

The agricultural sector saw a temporary surge, surpassing the $1-billion mark in FY 2021–22, but has since retreated. In FY25, agri-product exports stood at $988.62 million, up from $553.17 million in FY17—showing growth but failing to maintain earlier momentum.

Md Monirul Islam, DGM of Alin Foods Export Ltd, blamed the sector’s underperformance on policy shifts. “Cash incentives for agri exports were cut from 20% to 10% last year, significantly reducing competitiveness for small exporters,” he said.

Exporters also cited challenges such as higher input and freight costs, limited air cargo capacity, and inadequate infrastructure for the sector’s stagnation.

Export Basket Still Lopsided

The data underscores that Bangladesh’s export growth over the past decade has been overwhelmingly driven by the RMG sector, with non-RMG exports showing minimal progress. While total RMG exports rose by over $10 billion, many non-RMG categories declined or remained stagnant.

Analysts warn that without aggressive policy support, infrastructure investment, and product development in non-RMG sectors, the country’s export basket will remain overly reliant on garments—leaving it vulnerable to sector-specific shocks and international market shifts.