The Dhaka stock market extended its losing streak into a second consecutive week as cautious investors booked profits ahead of the upcoming corporate earnings season.

Analysts said shares of major blue-chip and sectoral leaders, which had rallied strongly in recent weeks, came under sustained selling pressure, pulling the benchmark equity index lower.

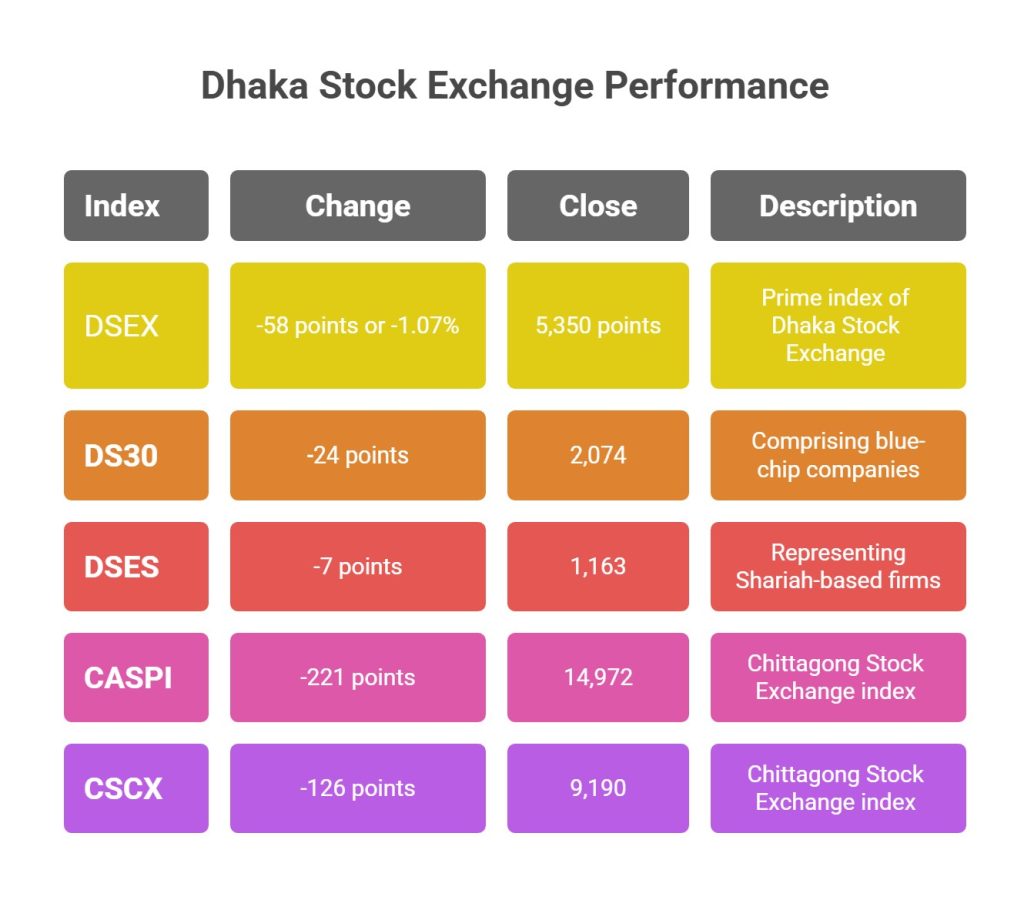

The week opened on a weak note, with profit-taking dominating the first four sessions before the final day staged a modest recovery. The DSEX, the prime index of the Dhaka Stock Exchange (DSE), dropped 58 points or 1.07% over the week to close at 5,350 points.

With this, the index lost 93 points in two weeks, erasing part of the 805-point rally seen over the prior eight straight weeks, during which market capitalisation had swelled by Tk 617 billion. Over the past two weeks, however, investors pulled back, wiping Tk 57 billion from the bourse’s market-cap, which stood at Tk 7.12 trillion at the week’s close.

“Profit-taking pressure along with cautious sentiment ahead of earnings disclosures drove the correction,” said a Dhaka-based stockbroker. He, however, expressed optimism about a short-term rebound given improving macroeconomic indicators and easing yields on government securities.

According to EBL Securities, large-cap stocks including Square Pharma, Grameenphone, Islami Bank, Pubali Bank, Social Islami Bank, BSRM, and Al-Arafah Islami Bank accounted for nearly 30 points of the DSEX decline.

The DS30, comprising blue-chip companies, shed 24 points to 2,074, while the DSES, representing Shariah-based firms, fell 7 points to 1,163.

Turnover, Sector Performance

Investor participation also cooled. Total turnover slipped to Tk 34.46 billion from Tk 36.46 billion a week earlier, even with five trading sessions versus the previous week’s four. Average daily turnover dropped 24% week-on-week to Tk 6.89 billion.

The banking sector retained the top spot in weekly turnover, contributing 24.4%, followed by pharmaceuticals (15.6%) and textiles (12.1%).

Sectoral performance was largely negative, led by telecom (-2.6%), banking (-1.6%), non-bank financial institutions (-1.5%), food (-1.1%), power (-0.9%), pharmaceuticals (-0.77%), and engineering (-0.45%).

Out of 396 issues traded, 274 declined, 99 advanced, and 23 remained unchanged.

Orion Infusion topped the turnover chart with Tk 2.13 billion worth of shares traded, followed by Bangladesh Shipping Corporation, City Bank, BRAC Bank, and Malek Spinning Mills.

The Chittagong Stock Exchange mirrored the decline, with the CASPI losing 221 points to 14,972 and the CSCX falling 126 points to 9,190, on a weekly turnover of Tk 758 million.