Rahima Food’s share price has jumped nearly 140 percent on the Dhaka Stock Exchange (DSE) in under two months, despite a sharp drop in profits during the first nine months of FY25.

The unusual rally prompted the DSE to issue a query to the company, asking whether any undisclosed, price-sensitive information was driving the surge. Rahima Food replied that no such information existed behind the recent spike in price and trade volume.

On June 15, the company’s shares traded at Tk 68 each. By August 7, the price had surged to Tk 161.70 per share, pushing its price-to-earnings (P/E) ratio to a staggering 461.54 — far above the sector’s average of 21.86, according to unaudited financial statements.

The DSE had earlier issued a similar query in mid-July when the price hit Tk 115 per share. Despite the warnings, the rally continued, with the stock exchange deeming the rise unjustified given the company’s weak financials.

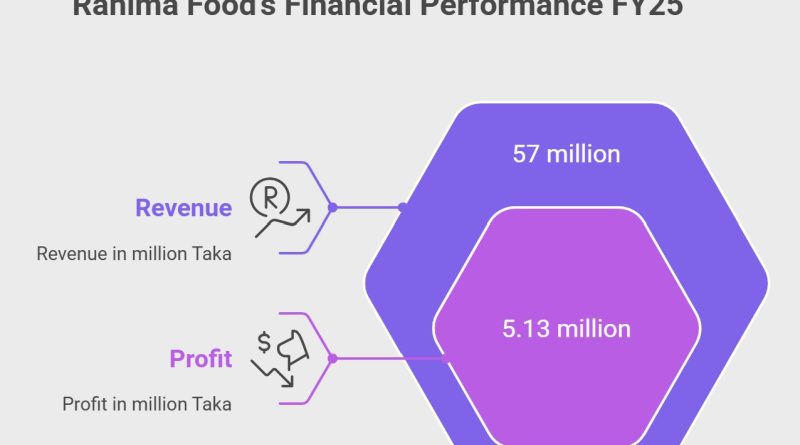

During July–March of FY25, Rahima Food’s revenue fell nearly 48 percent year-on-year to Tk 57 million, while profit plunged 69 percent to Tk 5.13 million. Analysts warn that such an elevated P/E ratio could indicate the stock is overpriced and vulnerable to steep corrections, especially if growth fails to meet expectations. In some cases, they note, high P/E ratios reflect speculative trading rather than strong business performance.

On Sunday, Rahima Food’s share price closed at Tk 160, down 1.05 percent from the previous session.

Meanwhile, in July, Rahima Food Corporation suspended coconut oil production due to low market demand. The company’s CFO said halting operations was more cost-effective than continuing at a loss.

“We have suspended it temporarily. Running this business is not profitable for us right now, but we will resume when we can ensure profitability,” he said.

City Group acquired Rahima Food in 2016, enabling the company to resume production in 2022. It paid a 10 percent cash dividend for both FY23 and FY24.