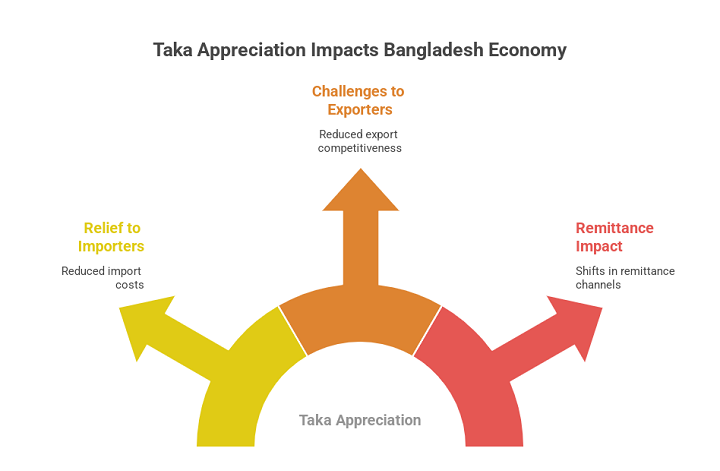

The recent appreciation of the Bangladesh Taka against major foreign currencies, particularly the US dollar, has stirred significant attention within the financial community, policymaking circles, and the broader economy. After a prolonged period of depreciation and exchange rate volatility, this turnaround in the Taka’s trajectory has brought relief to importers, posed challenges for exporters and remittance earners, and prompted fresh debate over whether this appreciation is a fleeting event or the beginning of a structural shift in the foreign exchange landscape.

To evaluate the sustainability of this appreciation, it is crucial to dissect the underlying balance of payments dynamics, trends in wage remittances, capital flow behavior, and the broader economic and policy environment. Each of these elements holds important clues to whether the recent movement in the exchange rate reflects genuine external sector strength or a short-term aberration induced by administrative or market anomalies.

The balance of payments provides the most comprehensive picture of a country’s external economic position. For an economy like Bangladesh, heavily reliant on exports, remittances, and capital inflows, the balance of payments is sensitive to changes in global demand, domestic economic policies, and geopolitical risks. In the past couple of years, Bangladesh experienced a significant deterioration in its current account, driven by surging imports amid elevated global commodity prices and sluggish export growth. These pressures were further compounded by capital flight and dwindling foreign exchange reserves, forcing the central bank to gradually allow market forces more influence over exchange rate determination.

Against this backdrop, the recent appreciation of Taka appears counterintuitive at first glance. However, a closer analysis reveals several plausible drivers behind the trend. One immediate factor has been the narrowing of the current account deficit. As global energy and food prices stabilized, Bangladesh’s imports have seen moderation. Simultaneously, the country’s exports have shown signs of recovery, particularly in readymade garments, which remains the dominant foreign exchange earner. While not yet robust, the export performance has been sufficient to reduce pressure on the current account.

Additionally, wage remittances have played a significant stabilizing role. After a period of stagnation, remittance inflows have seen a resurgence, largely due to a combination of formalization of remittance channels, seasonal trends, and incentive mechanisms such as government-backed cash incentive. Moreover, suppression of operations in shadow market has led wage remittances to be routed through official channels.The central bank’s steps to harmonize the exchange rate and to allow a moderate depreciation while announcing the crawling mid exchange rate have improved confidence in official channels. Migrant workers, who previously favored informal routes offering better rates, are now returning to formal banking networks, enhancing inflow transparency and accuracy.

That said, a deeper issue lurking in the background is capital flight and its influence on the financial account of the balance of payments. Despite modest improvements in the current account, the financial account continues to face challenges. Private sector borrowing from abroad has declined, and net foreign direct investment (FDI) remains tepid, reflecting both domestic macroeconomic uncertainty and global risk aversion. More importantly, capital flight through informal channels in recent past after the resume of caretaker government continues to erode confidence in the sustainability of any external sector improvement. This outflow creates a structural weakness that may likely limit the durability of Taka’s appreciation in near future.

Another factor behind the appreciation is the increased market scrutiny by the central bank which has adopted several administrative and policy measures aimed at stabilizing the foreign exchange market. Some of these are steps to monitor import transactions, discourage luxury and non-essential imports, and introduce stronger monitoring of trade-based money laundering. In the short run, these measures have had a positive impact by improving the supply-demand balance of foreign currency in the market. However, reliance on administrative tools rather than deeper reforms exposes the economy to renewed volatility if such controls are lifted or circumvented.

It is also important to consider the speculative behavior of market participants. Exchange rate movements often feed on expectations. Once a currency begins to appreciate, businesses and households tend to delay foreign currency purchases in anticipation of better rates. This can create a self-reinforcing cycle of appreciation, temporarily relieving pressure on reserves. However, such episodes are inherently unstable, as they are not grounded in fundamentals. Once expectations reverse, the currency may face renewed pressure, particularly if the underlying external position remains weak.

Moreover, Taka’s appreciation has coincided with a relative weakening of the US dollar globally, driven by expectations of interest rate pauses or cuts by the Federal Reserve. As the dollar loses steam, emerging market currencies, including Taka, often benefit. While this global factor should not be overstated, it does provide a supportive external environment for appreciation, even if temporarily.

Despite these short-term positives, the sustainability of Taka’s appreciation rests on more enduring structural reforms. First, the foreign exchange regime needs further liberalization. While introducing market-based exchange rate, full convertibility on current account transactions must be enforced. A transparent, rule-based FX market encourages investor confidence, improves the allocative efficiency of resources, and supports long-term capital inflows.

Second, domestic monetary and fiscal policies must align with exchange rate management. A loose fiscal stance, monetized deficits, or politically motivated lending programs will undermine efforts to maintain external balance. Similarly, interest rate caps, directed credit, and liquidity injections for ailing institutions distort financial signals and weaken the link between exchange rate and macroeconomic fundamentals.

Third, there is an urgent need to rebuild foreign exchange reserves. The current reserve level, although slightly improved, remains below the comfort zone for a country with a large trade imbalance and heavy import dependency. Rebuilding reserves requires both increased external earnings and disciplined reserve management. Import substitution policies and export diversification strategies should be vigorously pursued, but not at the cost of productivity or openness.

Fourth, the government and central bank must act decisively to curb capital flight. This means not only enhancing surveillance and compliance but also improving governance and reducing the incentive for illicit outflows. Transparent public procurement, streamlined taxation, and greater financial sector oversight are essential in this regard.

Fifth, the economy is in transition though it is going to be graduated from LDC status. The recent downward trend in import does not reflect actual needs of the economy. The expected growth path needs more investment, enhancing import trade. As a result, the balance of payments will again be pushed back in negative territory. This is a changing situation to maintain Taka value at moderate level. However, the informal economy’s large footprint needs to be reduced. Parallel currency markets thrive when access to formal channels is restricted or unreliable. Reforms that promote financial inclusion, reduce transaction costs, and modernize payment infrastructure can help bring these transactions into the formal economy. This can maintain wage remittances flows. One dollar outflow through official channel can reduce the damand up to the same extent in shadow market.

Finally, political and institutional stability will play a crucial role. Exchange rate dynamics are not merely technical issues; they reflect broader confidence in a country’s economic and governance frameworks. Investors and remitters are more likely to trust a system where institutions function independently, policies are predictable, and the rule of law prevails. In this case, convenience is a factor. Formal channel needs to be made user friendly.

In sum, the recent appreciation of Taka is a welcoming development in a period marked by external volatility and macroeconomic stress. It reflects a combination of improving current account trends, enhanced remittance flows, administrative measures, and a supportive global currency environment. However, it also conceals underlying reason pertaining to slow demand in the economy, resulting in downsized imports. The lower is the import, the better is the trade balance.

The appreciation could be sustained if these deeper issues are addressed through coherent reforms and prudent macroeconomic management, including close monitoring of the market. Otherwise, the current strength of Taka may prove ephemeral – another short-lived cycle in a structurally fragile exchange rate landscape. The path forward must involve an intervention strategy to intervene with transparency, anchored by sound fundamentals, resilient institutions, and a commitment to transparency and reform. Only then Taka’s value can be defended not through intervention, but through confidence. The central bank needs to be vigilant in monitoring transactions to protect foul-plays as well.

The author works in the development sector and can be reached at mehdirahman82@gmail.com