Short-term foreign loans to Bangladesh’s private sector fell below the $10 billion mark in August, hitting an eight-month low amid subdued import demand and slower private investment.

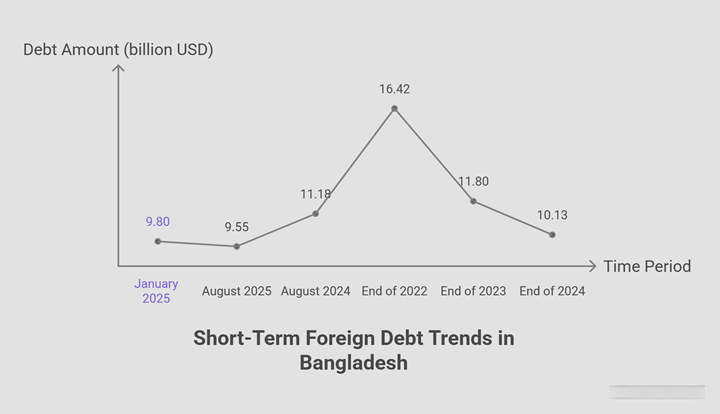

According to Bangladesh Bank data, outstanding short-term foreign debt stood at $9.55 billion at the end of August 2025, down from $9.80 billion in January and $11.18 billion a year earlier — a 14.6% year-on-year decline.

Economists and bankers attribute the drop to lower import-related financing, particularly buyer’s credit, which businesses use to fund imports of capital machinery and raw materials.

“Short-term foreign loans are trade-related, and the decline reflects weaker import and investment demand,” said Zahid Hussain, former lead economist at the World Bank’s Dhaka office. “Earlier, a dollar shortage constrained borrowing, but now reserves have improved — so if demand picks up again, foreign lending should also recover.”

Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank, said LC openings have decreased compared to previous months, naturally reducing buyer’s credit volumes. “SOFR rates were also high earlier, but with rates easing, borrowing may soon rebound,” he added.

Trade and credit data point to slowdown

Central bank figures show import settlements fell to $4.88 billion in August, down 10.9% from $5.48 billion a year earlier. Buyer’s credit hit its lowest level in months at $4.54 billion.

Bangladesh’s total short-term foreign debt has been on a steady decline — from $16.42 billion in 2022 to $11.80 billion in 2023, and $10.13 billion by end-2024.

In August 2025, new short-term foreign borrowing totalled $1.42 billion, while repayments reached $1.89 billion, marking the lowest inflow since the beginning of the year.

Bangladesh Bank data also show imports of capital machinery fell by nearly 12% in the first two months of the current fiscal year, underscoring weaker investment appetite in the private sector.