The Dhaka Stock Exchange (DSE) closed the week lower for a second straight time, with investors staying on the sidelines ahead of corporate earnings disclosures.

The benchmark DSEX index dropped 74 points, or 1.34%, to 5,450, losing a total of 164 points over the past two weeks. Market capitalisation shrank by Tk 33 billion during the same period. The blue-chip DS30 shed 44 points to 2,107, while the Shariah-based DSES declined 18 points to 1,178.

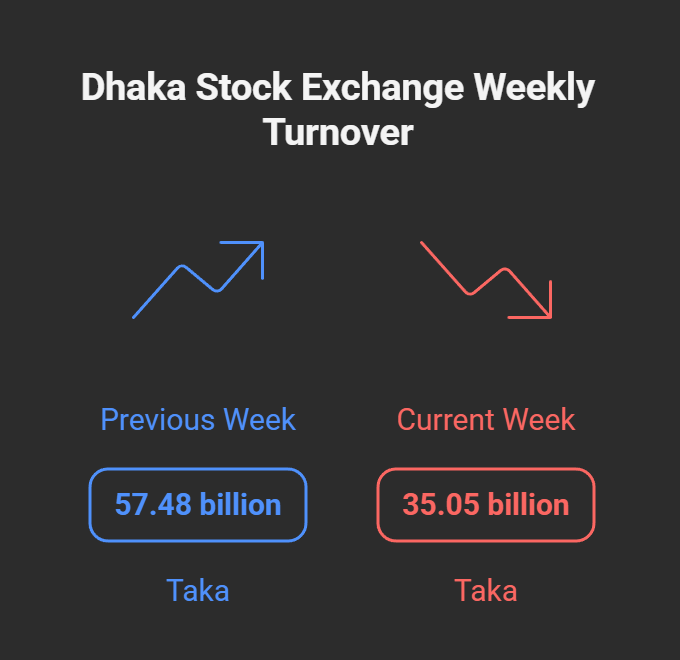

Investor participation fell sharply, with weekly turnover plunging 39% to Tk 35.05 billion from Tk 57.48 billion a week earlier. Average daily turnover stood at Tk 7 billion, down from Tk 11.5 billion.

Market analysts said institutional investors have been reluctant to deploy fresh funds, while retail participants held on to cash. Some investors opted for selective portfolio reshuffling, while others locked in quick gains.

Price fall in major stocks such as BRAC Bank, Beximco Pharma, Social Islami Bank, Robi Axiata and City Bank dragged the index down by 33 points alone. EBL Securities noted that the correction phase continued as investors adopted a defensive stance in the absence of positive catalysts.

However, speculation of a policy rate cut is emerging after yields on government securities eased, with the 10-year bond dipping below 10% for the first time in two years. Analysts believe this could provide fresh momentum to the market in the coming weeks.

Concerns over market manipulation linger as three junk stocks—Shyampur Sugar Mills, Bangladesh Finance and Metro Spinning—featured among the top 10 gainers, surging between 11% and 17% during the week.

Sector-wise, non-bank financial institutions suffered the steepest fall at 6.5%, followed by telecom (2.06%), food (1.3%), pharma (1.23%), banking (0.96%) and power (0.83%). Pharmaceuticals, engineering and banking together accounted for 36% of total turnover.

On the DSE floor, losers dominated with 306 issues declining against 68 gainers and 23 remaining unchanged. Khan Brothers PP Woven Bag Industries topped the turnover chart with Tk 1.58 billion, followed by Summit Port Alliance, Robi, Asiatic Laboratories and Techno Drugs.

The Chittagong Stock Exchange also ended lower, as the CASPI fell 181 points to 15,338 and CSCX dropped 109 points to 9,419. Turnover stood at Tk 671 million with 22.9 million shares and mutual fund units traded.