The government may be forced to inject up to Tk30,000 crore in taxpayer money to rescue the country’s fragile financial sector, with as many as 20 non-bank financial institutions (NBFIs) heading toward liquidation and five Islamic banks set for a state-led restructuring.

According to Bangladesh Bank Governor Ahsan H Mansur, this large-scale intervention will be required to stabilise a sector plagued by poor governance, ballooning non-performing loans (NPLs), and institutional insolvency. The bailout, he confirmed, will come from the national budget.

Mass Liquidation of NBFIs Looms

The central bank has identified 20 NBFIs for potential liquidation, with a projected cost of Tk10,000–12,000 crore in depositor compensation. These institutions, already on the Bangladesh Bank’s “red list,” are largely non-functional, and most of their loans are now classified as non-performing.

The liquidation effort is being framed as part of a larger strategy to “clean up the industry.” However, legal limitations have until now prevented the government from offering deposit protection to NBFI clients. To plug that gap, the recently amended Deposit Insurance Act will now extend coverage of up to Tk2 lakh to NBFI depositors — a significant policy shift.

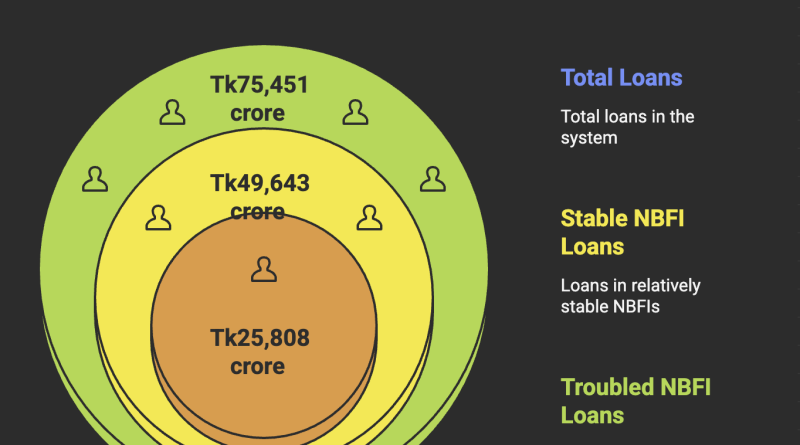

Out of 35 NBFIs operating in Bangladesh, only four or five are currently deemed financially sound. A Bangladesh Bank report from December 2024 revealed that NBFIs held Tk75,451 crore in outstanding loans, of which Tk25,089 crore (33.25%) were non-performing.

The 20 troubled NBFIs alone account for Tk25,808 crore in loans — with a staggering 83.16% of that classified as non-performing. These loans are backed by just Tk6,899 crore in collateral. Many of the institutions are allegedly tied to PK Halder-style embezzlement schemes, further eroding depositor and investor confidence.

Among the institutions flagged for liquidation are:

CVC Finance, Bay Leasing, Islamic Finance, Meridian Finance, GSP Finance, Hajj Finance, National Finance, IIDFC, Premier Leasing, Prime Finance, Uttara Finance, Aviva Finance, Phoenix Finance, People’s Leasing, First Finance, Union Capital, International Leasing, BIFC, Fareast Finance, and FAS Finance — seven of which have default rates exceeding 90%.

These firms collectively hold deposits worth Tk22,127 crore, of which 74% are institutional and 26% are from individuals. The central bank has issued show-cause notices to all 20 entities and will proceed with liquidation if responses are deemed unsatisfactory.

In contrast, 15 relatively stable NBFIs hold a combined Tk49,643 crore in loans, with a much lower NPL ratio of just 7.31%.

Islamic Banks Also Under Scrutiny

The government’s financial burden does not end with the NBFIs. Bangladesh Bank is also moving ahead with a planned merger of five distressed Islamic banks — a move that could require an additional Tk15,000–20,000 crore in recapitalisation during the first phase.

The banks targeted for merger are:

First Security Islami Bank, EXIM Bank, Social Islami Bank, Union Bank, and Global Islami Bank.

A recent external audit commissioned by the central bank revealed that these banks suffer from severe loan defaults — ranging from 60% to 95%. As a result, the government plans to provide capital support through bond issuance under a recapitalisation scheme. Initially, interest payments will be budget-funded, while the principal will be raised via long-term government bonds.

The longer-term strategy is to restructure and eventually privatize these banks, with shares to be offloaded in the stock market. Governor Mansur also indicated that the government is open to full foreign ownership of the restructured entities.

Sector Reform: A Necessity, Not a Choice

Financial analysts say these moves, while costly, are critical to restore market discipline. Md Ahsan Habib of the Bangladesh Institute of Bank Management (BIBM) noted that most NBFIs failed in basic due diligence and client screening, leading to the current crisis.

He urged a stronger regulatory framework and reforms in bond and securities markets to support long-term financing — the core function NBFIs were originally intended to serve.

As the financial sector braces for a massive shake-up, experts say transparency, accountability, and institutional reform must go hand in hand with public bailouts to prevent a repeat of past failures.