A sweeping new countervailing tariff regime introduced by the United States takes effect today, fundamentally altering the cost dynamics for apparel exports from major manufacturing hubs to the U.S. market. Under the new rules, tariffs will vary by country, replacing the previous system of relatively uniform duty rates. As a result, the competitive landscape among textile-exporting nations is poised for a major shake-up.

The U.S. Customs and Border Protection will now impose an additional 20% countervailing duty on certain Bangladeshi products, including cotton T-shirts, effective from 00:01 AM Eastern Time (10:01 AM Bangladesh time) on Thursday. Goods loaded onto U.S.-bound vessels after that point—such as those currently docked at Chittagong port—will be subject to the new surcharge. It typically takes 30–45 days for cargo to reach American ports.

What This Means for a Single Cotton T-Shirt

Data from the U.S. International Trade Commission and U.S. Harmonized Tariff Schedule was used to illustrate the impact of the new tariffs using a common export item: a cotton T-shirt.

Last year, Bangladesh exported each T-shirt to the U.S. at an average price of $1.62. Previously, U.S. importers paid a standard duty of 27 cents (16.5%). With the new 20% countervailing duty, importers will now incur an additional 32 cents, bringing the total duty per T-shirt to approximately 59 cents—a 36% increase in import cost.

How Bangladesh Compares

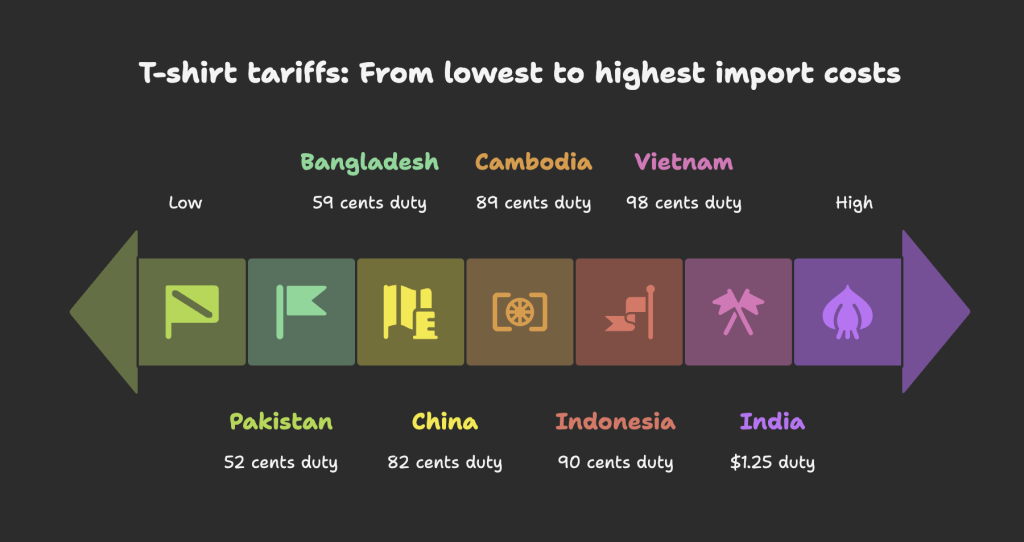

Despite the new duties, Bangladesh remains price-competitive compared to several of its peers:

India, a major competitor, faces a cumulative 50% tariff following a second 25% hike imposed Wednesday. As a result, U.S. importers must now pay $1.25 in duties per Indian T-shirt.

Vietnam also fares worse, with a combined duty of 98 cents per T-shirt.

China, despite underpricing Bangladesh on export value, faces heavy penalties due to trade war measures. Assuming a 30% countervailing tariff, the total duty for a Chinese T-shirt would amount to 82 cents.

Other competitors face varied tariff burdens:

Indonesia: 90 cents

Cambodia: 89 cents

Pakistan: 52 cents

Among these, only Pakistan enjoys a lower per-unit tariff than Bangladesh—by just 7 cents. For all other countries, U.S. importers must now pay more per T-shirt than for Bangladeshi products.

Two Emerging Threats Pushed Aside

Once considered rising threats, Myanmar and Ethiopia have effectively been sidelined from the competitive arena:

Myanmar now faces a 40% countervailing duty, raising the per-T-shirt cost to $1.88—more than the export value itself.

Ethiopia, formerly eligible for duty-free access under the African Growth and Opportunity Act (AGOA), was expelled from the program in January 2022 due to violations of trade conditionalities. The country now competes on equal tariff footing, significantly diminishing its cost advantage.

Top Exporters Now Feeling the Pinch

The two largest cotton T-shirt exporters to the U.S. last year—Nicaragua and Honduras—had previously benefited from zero-duty access under the CAFTA-DR trade agreement. But recent changes have affected them as well:

Nicaragua is now subject to an 18% countervailing tariff.

Honduras saw U.S. Customs collect 10% in duties on average per T-shirt this past May.

Strategic Positioning: Bangladesh in the Tariff Matrix

According to Bangladesh’s National Board of Revenue (NBR), the U.S. is its largest single export destination, with total exports amounting to $8.76 billion last fiscal year. Of that, $7.6 billion came from ready-made garments (RMG).

Previously, the average effective tariff rate on Bangladeshi goods was 15%, and 16.77% specifically for apparel. The new 20% surcharge raises the effective rate but does not place Bangladesh at a disadvantage relative to key competitors.

In fact, exporters suggest the country retains a strong cost position. Compared to Vietnam, Bangladesh remains similarly positioned. It enjoys a tariff advantage over India and China, while the marginal difference with Pakistan, Cambodia, and Indonesia is not considered commercially significant.

Industry Outlook: “The 35% Fear is Behind Us”

Speaking on condition of market anonymity, Mohammad Abdus Salam, Managing Director of top-tier exporter Asian-Daff Group, expressed cautious optimism:

“Nicaragua and Honduras are no longer our benchmarks. We are still on par with Vietnam, ahead of India and China, and only marginally behind Pakistan and Indonesia. Ethiopia is no longer in the race. The earlier fear of a 35% duty has passed. We’re still in the game—possibly better positioned than ever.”