An overwhelming majority of businesses in Bangladesh say the tax regime is unfair, burdensome, and riddled with corruption, according to a new survey by the Centre for Policy Dialogue (CPD).

The study found that 82% of companies believe current tax rates hurt business growth, while nearly four in five flagged a lack of accountability among tax officials. About 72% cited corruption, and 65% said they face persistent disputes over arbitrary tax claims.

“Officials often impose taxes without proper justification or prior communication. The uncertainty becomes a bigger burden than the tax itself,” one business leader said during the survey dialogue.

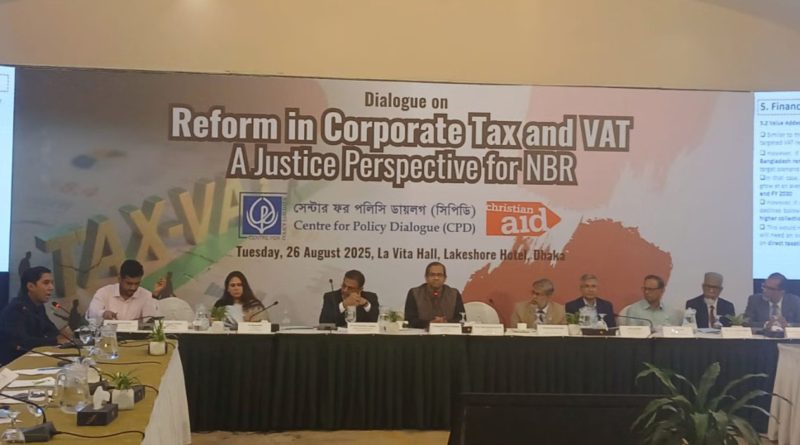

The CPD, in partnership with Christian Aid, surveyed 123 companies in Dhaka and Chattogram for the tax study.

A separate survey, conducted among 389 firms in Dhaka and surrounding districts, revealed that 73.5% consider the multiple VAT rates and complex laws as major obstacles. Respondents also pointed to vague rules, poor cooperation from officials, high compliance costs, and limited awareness or training on VAT procedures.

Business leaders argued that the combination of unfair rates, arbitrary practices, and legal complexity not only raises costs but also discourages compliance, stifling competitiveness.