Bangladesh’s merchandise exports dipped 2.93 per cent year-on-year to US$3.91 billion in August 2025, down from $4.03 billion in the same month last year, Export Promotion Bureau (EPB) data showed Tuesday.

The decline came despite a robust start to the fiscal year, when exports surged about 25 per cent in July, fetching $4.77 billion. Cumulatively, shipments grew 10.61 per cent year-on-year to $8.68 billion during the first two months of FY26.

The setback in August was largely driven by the readymade garment (RMG) sector, which earned $3.16 billion, down 4.75 per cent year-on-year. Within RMG, knitwear exports dropped 6.34 per cent to $1.77 billion, while woven garments declined 2.65 per cent to $1.39 billion.

Still, the RMG sector posted a 9.63 per cent rise in July–August earnings to $7.13 billion compared to $6.50 billion in the same period last year.

EPB noted that while July’s strong performance highlighted resilience, the August dip reflected challenges from global demand fluctuations and shifting market dynamics.

Fazlee Shamim Eshan, executive director of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said last year’s August base effect played a role. “Many factories were closed for at least 10 days in August 2024, so this year’s earnings look weaker by comparison,” he explained. He added that closures in Ashulia and weaker EU orders also dragged down shipments.

Exporters further pointed to front-loaded shipments in July—rushed out to offset possible higher US tariffs under the Trump administration—which reduced August’s volumes.

Mixed performance across sectors

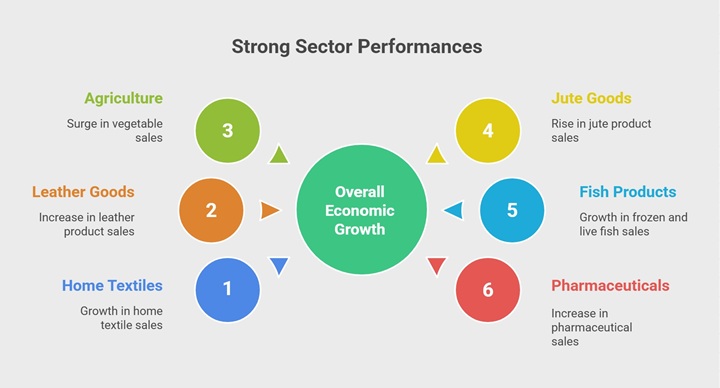

Outside apparel, several sectors performed strongly:

- Home textiles: +12.68% to $139.02m

- Leather & leather goods: +13.68% to $228.76m, though leather footwear fell 11.18% in August

- Agriculture: +3.96%, led by vegetables soaring 58.13% to $174.67m

- Jute & jute goods: +6.96% to $118.56m

- Frozen & live fish: +32.45% to $81.55m

- Pharmaceuticals: +26.12% to $36.46m

Trade analysts said the August numbers underline both the strength in non-RMG exports and the vulnerability of Bangladesh’s reliance on garments, which still contribute over 80 per cent of total export earnings.